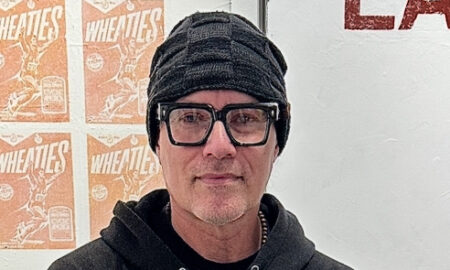

Today we’d like to introduce you to Joshua Grayson.

Joshua, can you briefly walk us through your story – how you started and how you got to where you are today.

With just 0.27 cents in my pocket, I remember moving to Dallas, Texas in 2014. I was homeless with no plan, no idea, nor did I know anyone in Dallas. Some might call this move crazy, but I called it FAITH. The God that I serve says that “Faith without works is dead.” While I was homeless, I heard God tell me to “position myself.”

After analyzing my new journey in life, I started applying for 200-300 jobs online from my cell phone. My first employment here at Wal-Mart was short-lived due to a severely damaged Achilles tendon from playing basketball in my first week here. My second hire was in my second year here at a car dealership called Auto America with the top credit repair companies in the industry.

From there, I started living from the benefits of having excellent credit, from 5% cashback on my credit cards everytime I spend they pay me

I was able to obtain transportation for work, but something I actually wanted like my Range Rovers and Hummers SUT with rates under 3%, never putting any money down and full coverage auto insurance under $105.00.

The amount owed now is $10,000. Month by month my team and I will investigate it until Trans Union, Equifax and Experian delete the account. Maybe your parents or uncle opened a water bill or utility bill in your name, legally the credit bureau must prove you gave authority to do so or delete the negative account from your all three credit reports.

We show you at New Credit Law what exactly to apply for, we help you build a new personal history.

(1 Corinthians 13:11 KJV). I really believe you can change your situation, by finding a few good scriptures that make sense to you. God’s word said by the renewing of your mind, in order for any change to take place, how you think about a thing must first be different.

My interest when I was young was reading, acting, playing football/basketball, cooking, traveling. I’ve always had a heart to serve others no matter what got them to the challenges they’re in. I fell like I could always think my out of any problem.

After all, my negative accounts were deleted for hiring credit companies, I realized a huge problem in the industry, with over 100 million credit restoration companies on Google, I noticed none of them solved the main problem for consumers after the debt is removed. Just like the top companies in the industry, the others were not informing me properly or educating me about the two most vital steps concerning your credit report, so I created the next steps 2-3 in repairing credit. After creating these steps, my credit report changed drastically. I increased all three of my credit scores from a 487 to 786 in one month, with all my negatives being deleted in 12 months! When I found this information out, I began to assist my family and friends with their credit report, which led to new clients on my social media platforms requesting my services after seeing my credit report results, success and failures. This is how my credit report company was launched and birthed, following the old successful Laws and creating the new I called it New Credit Law.

We’re always bombarded by how great it is to pursue your passion, etc – but we’ve spoken with enough people to know that it’s not always easy. Overall, would you say things have been easy for you?

Has this been a smooth road? Yeah right, I wish! But it wasn’t, and that’s okay because I’ve learned some of the most priceless information during this journey. It’s something I call “Purposeful Hiccups.” One of the main struggles of building my company was to trust the timing. Credit restoration is a process, sometimes a long process, but never the less; it’s rewarding and life-changing. Another struggle along the way was helping the wrong people, it was expensive financially; but on the bright side, I learned some skills that allowed me to grow further. I was also taken advantage of by the people who I loved most and made some costly mistakes that made me realize that it’s better to lose money than to lose your excellent credit health. Friends I tried to help, favors I’ve done, all came back to stab me in the back.

A major struggle that New Credit Law endured was when my business partner at the time committed robbery and Defamation against New Credit Law, leaving my staff and I unpaid for months, I apologized, believed God, and kept moving forward. I went through so many ups and downs building this credit company, but by the grace of God, New Credit Law always looks forward and has become a 6-figure company in less than five months.

Please tell us about New Credit Law.

Once I increased my credit score to the 800’s, I used Tradelines to increase the other 40+ points. From there I started living from the benefits of having excellent credit, from 5% cashback on my credit cards every I spend they pay me. Having an excellent score ( 790 or higher ) put me in a position where I could purchase vehicles I wanted and not because I had to “settle for it.” I was able to obtain Range Rovers and Hummers SUT with rates under 3%, never putting any money down and auto insurance under $110.00. Yes, you read that correctly! Car insurance is structured around your credit score!

Repairing credit is no joke. It gives you the power to unlimited credit cards and access to the lowest rates in the country! Most people aren’t even aware of the types of benefits they can really live on. I started to see that most people don’t want to be independent or repair their life. They’d rather take the quick expensive route, which is doing a settlement with a collection company or consolidating, which is another terrible mistake. Here’s why, when you do either one, yes you stop them from harassing you, However, the negative debt remains on your credit profile with a new start date that can remain on your credit profile as a negative account for 7-10 years. One negative account can potentially destroy your score 100+ points!

I left corporate America in 2018 after building my company New Credit Law, to a six-figure company in less than five months, all from my iPhone. New Credit Law is a consumer conciliation group that investigates inaccurate, unfair, unverifiable or erroneous negative information displayed on client reports. Our motto at New credit Law is: Prove it or Remove it! In basic terms, we investigate the negatives items on your credit report using credit laws. My dream is for everyone to Live The Life You Deserve, We act as your advocate, demanding the credit bureaus to delete the account. This is the fastest way to increase your credit score, freeing you as the consumer from any debt they delete. Sounds cool right? I know! Let me give you an example: Let’s say a relative or stranger stole your identity and opened up a student loan or water bill into your name. The amount owed now is $10,000. Month by month my team and I will investigate it until Trans Union, Equifax and Experian delete the account.

After that you, you no longer owe that debt! I always tell people to NEVER settle or consolidate debt! My team and I are experts at not only increasing credit scores in less than 90 days but also assisting you in getting independent no matter the struggles, credit repair is a process that’s worth the journey. We show you what new credit to apply for, we help you build a new personal history. The part I’m excited about is we are also the only credit repair company with a Rates Department. In our interest rate department, we assist you in getting the lowest APR according to your credit score for the purpose that you signed up and guess what? This is at no extra cost to our clients.No other credit repair company does that! We want to be apart of the entire process to show you why having a good credit score is so imperative. At New Credit Law, we’ve assisted clients in over 38 states and Canada.

What were you like growing up?

Well, do we ever stop growing up? While some people have, I want to submit to you that you should never stop growing, no matter how old you are. Growing up I was very inquisitive, silent and I processed a lot internally. Hardship has become my norm. I’ve been evicted time after time, homeless a few times, sold drugs, gang affiliation and had criminal and drug felonies.

So the old me was a mess, the child part of me. Growing up, sleeping on cardboard boxes with roaches and mice, cultivated a different desire for me to come out of poverty and educate minorities. One of my favorite bible verses states: “When I was a child, I spake as a child, I understood as a child, I thought as a child, but when I became a man, I put away childish things (1 Corinthians 13:11 KJV). God has cultivated me and shifted my ideology to knowing there’s understanding, in perception and how you see the image of life.

Another one of my favorite words from God is “For who hath despised the day of small things? for they shall rejoice! (Zechariah 4:10 KJV). God always has a better plan for your life no matter how your upbringing is. At one point there will be a breaking that takes place.

I wanted to know a lot about being an adult. I watched my single-parent mother struggle and work the longest hours in a day to provide for her 8 kids by herself as my dad was incarcerated. I just wanted to help, I loved how my mother modeled being independent, and I wanted to be that. I wanted to clean and cook for people every day and work and pay bills because that’s all I was exposed too inside the house.

I started working at the age of 14 Delivering newspapers at 2 AM. Then started cooking, cleaning as an adolescent because I just wanted to help my mom. My interest when I was young was reading, playing football/basketball, cooking, traveling. I’ve always had a heart to serve others no matter what got them to the challenges they’re in. I fell like I could always think my out of any problem.

Pricing:

- $245: covers all credit report access plus a tailored plan

- $100 Jasper Status

- $150 Emerald Status

- $120 Sapphire Status

Contact Info:

- Address: 4621 S. Cooper St. Suite 131 box #422

Arlington TX 76017 - Website: www.newcreditlaw.com

- Phone: (866)907-3529

- Email: admin@newcreditlaw.com

- Instagram: IG @Joshuakgrayson FB: Joshuaking Grayson

- Facebook: FB Business page: New Credit Law

Suggest a story: VoyageDallas is built on recommendations from the community; it’s how we uncover hidden gems, so if you or someone you know deserves recognition please let us know here.