Today we’d like to introduce you to Tiffany Alphonse.

Hi Tiffany, we’re thrilled to have a chance to learn your story today. So, before we get into specifics, maybe you can briefly walk us through how you got to where you are today.

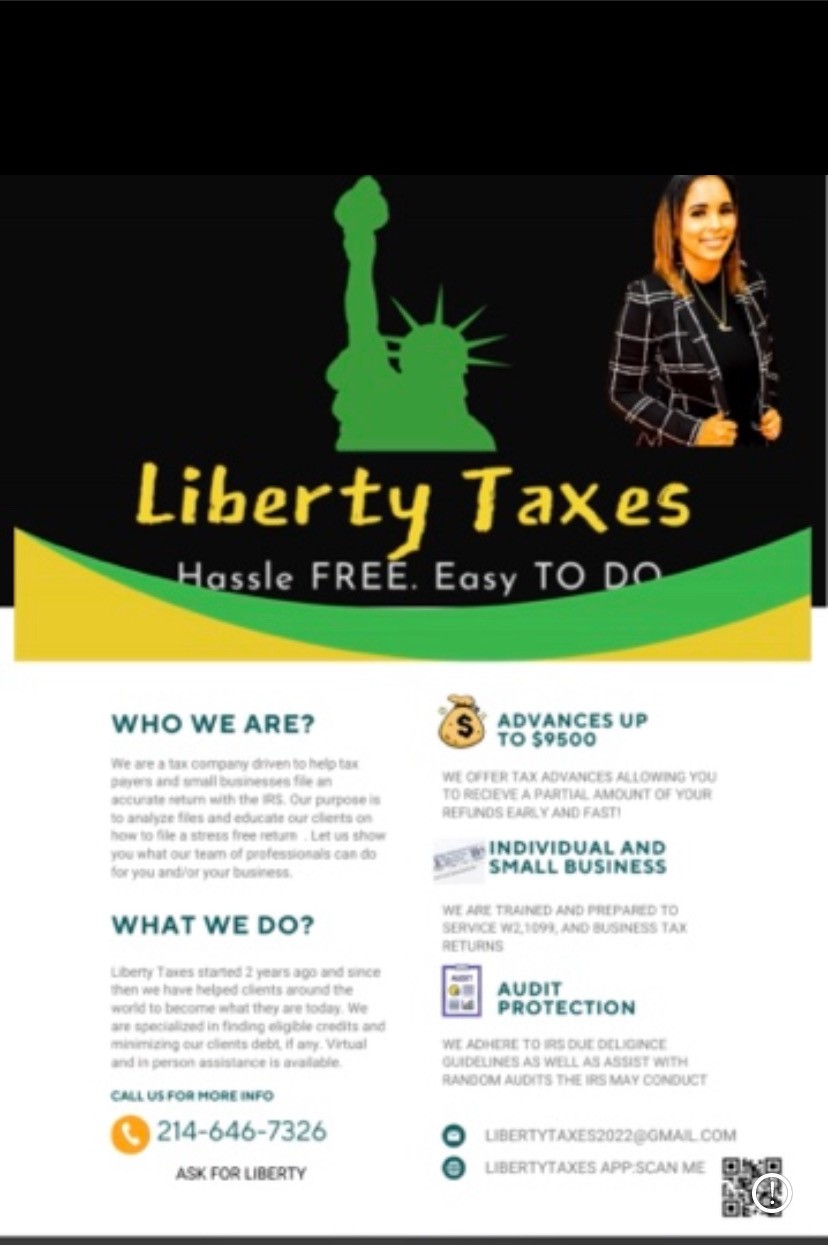

This journey started as a part-time hobby. I was a single mom, ambitious, and I loved to shop! Introduced to a few people who deliberately told me I would be a good asset in the tax industry, so I expressed interest and decided to give it a spin. I worked a 9-5, attended college online, then would drive to a tax office in Arlington (40mins away from where I resided) at least 3 times a week during tax season. I started off as simply recruiting clients. I would receive a percentage for payout from the tax owner, but never really understood the logistics of preparing or charging fees for taxes. The second year, I decided that I wanted to be more hands-on, and I linked with a different tax owner who would allow me to advance myself in the tax industry. It was not as pleasant as I would have wanted; however, I appreciated the opportunity. Honestly, I’m self-trained. I remained part-time for about another 4 years, still worked a 9-5 as main source of income. Switched between a few tax offices, but I knew still I was not reaching my full potential. What I discovered is some people genuinely want to see you win, and some people just do what’s best for them and their gains. About the sixth year, I was able to focus more on the tax industry, and I decided I wanted to branch off on my own. I was already recruiting my own clientele 100%, already training myself on all the required updates, etc., so I came to my senses of focusing and putting my all into the tax industry, I was working independently anyways. Branching off on my own started out as a learning curve. Here, I had to spend hours and hours of strategic training because, as previously mentioned, I only knew what I personally researched about taxes. After about 100 hours of consistent training and seminars, I was angry with myself for not researching the information sooner! I had taken a few investment losses, and I realized that my focus should have been on taxes years ago! In all honesty, it was definitely worth the long hours of training! 2021, I birthed Liberty Taxes LLC. My first year of owning my own tax business, I had two employees. I learned more of the back end of owning a tax business and marketing. Now here I am, my second year of being in business on my own, with over 18 contracted employees. I hired mostly single moms. This was definitely intentional. I just wanted to enlighten them on a seasonal source of income that could potentially provide five to six figures of extra income. My part-time preparers discovered how flexible and convenient this opportunity was. I teach from the basics of understanding the terminology used in the tax industry to recognizing self-worth while providing great customer service. We service hundreds of clients and currently based in Duncanville, Texas. There are plans on expanding to a few other states next season. It’s like, I really just needed to take a chance on myself and believe that I could and would do better on my own. Turned out I was right! It’s still all a learning experience, and it will only get better and better. Now, I attempt to build relationships with morally structured individuals that can produce positive energy and benefits to my company. Being a business owner is NOT for the weak, there are plenty of ups and downs that come with it. Your progress is based off of your willingness and dedication. So, with that being said, I’m still learning, structuring, and setting goals. I plan to introduce the tax industry to at least 75-100 new individuals next season while also incorporating credit repair. I set big goals, and I make sure my plans and strategies are aligned to fulfill just that! I am soooo Proud of myself. The first in my family to own a business. Liberty Taxes LLC, where the slogan is “hassle-free. Easy to do.” This is still only the beginning. Forever grateful.

I’m sure you wouldn’t say it’s been obstacle free, but so far would you say the journey has been a fairly smooth road?

This has not been a smooth road in the beginning. First, I had to change my environment in order to grow. Being around negativity, domestic violence, and poverty can definitely take a toll. Next came previous partnered tax owners attempting to take possession of my clientele as well as withholding funds if I decided to not sign another yearly contract. I realized sometimes you have to just let go and let God handle things, and everything will go as it’s “need” to versus how you “want” it to. Then, determining which tax software is the best fit, deciding what bank I would rather partner with, etc. When you don’t have guidance, there is a lot of time required to figure out what works best for you. Finally, learning to fully separate personal and business. Meaning not hiring people based on me wanting them to do better but focusing more on individuals who want to do better and just not sure how. Unfortunately, my building ended up flooding mid-season, had me closed at the peak of tax season for almost an entire month. Had to come up with temporary meeting locations to service clients. I would consider these my most difficult struggles overall that affected me mentally, emotionally, and financially throughout this journey.

Thanks for sharing that. So, maybe next you can tell us a bit more about your work?

My government name is Tiffany; however, most people know me as Liberty. Yes, there is a meaning behind the name. Liberty for me comes from all of the obstacles I’ve faced/encountered, regardless how difficult they were, I faced them and stood tall through it all. I specialize in individual and small business taxes. Mostly known for being dependable thorough, understanding, tenacious, and consistently available towards my clients. Accountable, informative, open-minded, and “family” towards my employees. What I’m proud of the most is that even though I didn’t know much about the tax industry at first, I decided to focus in with tunnel vision, and regardless how many years it took, I never gave up. What separate me from others is again, I’m self-taught. I don’t have a standard way of working files; each client gets a different version of me. And my preparers. To elaborate, I listen to my clients, come up with a few options for them, educate them, then let them decide what they feel would work best for them and their situation. We treat our clients like family.

Is there something surprising that you feel even people who know you might not know about?

I’ve had problems with domestic violence, depression, and PTSD. I know a lot of people don’t really speak out on their weaknesses; however, acknowledging and speaking up about it motivates me to help other people who may also struggle with these disorders or situations. I know we tend to act strong and carry on, but depression is real. It’s not easy trying to bring forth change, and sometimes it can get lonely and frustrating. My purpose for pushing extra hard is to make a difference as well as continue to find things I’m passionate about to bring forth happiness. I don’t train preparers to work for me; I train them to make them knowledgeable. There is no timeframe of how long a preparer is required to work for my company. I want them confident and knowing that if they want to branch out on their own, I’m available to assist. I want them to WIN BIG! This is why we handle all client files on a case-by-case basis. I understand things happen, so I attempt to lighten the load by finding eligible/beneficial credits a client may not be aware of and making their tax filing a pleasant and stress-free experience. Liberty Taxes LLC offers in-person and virtual filing. We also offer advances for those that need money right away. There are no upfront fee requirements, meaning it’s optional to wait until the IRS release funds for payment. There is audit protection that’s utilized frequently for those who want the extra protection. Everyone doesn’t have a bank account, so we have a check cashing machine in office as well. A person can file with comfort from their couch and be provided a full copy to their email. There are just so many different options and opportunities we offer. You never know what all a person is battling, so the overall goal is to educate and elevate the most effective way as possible.

Contact Info:

- Website: www.Libertytaxesllc.com