Today we’d like to introduce you to Mark Borge.

Hi Mark, thanks for joining us today. We’d love for you to start by introducing yourself.

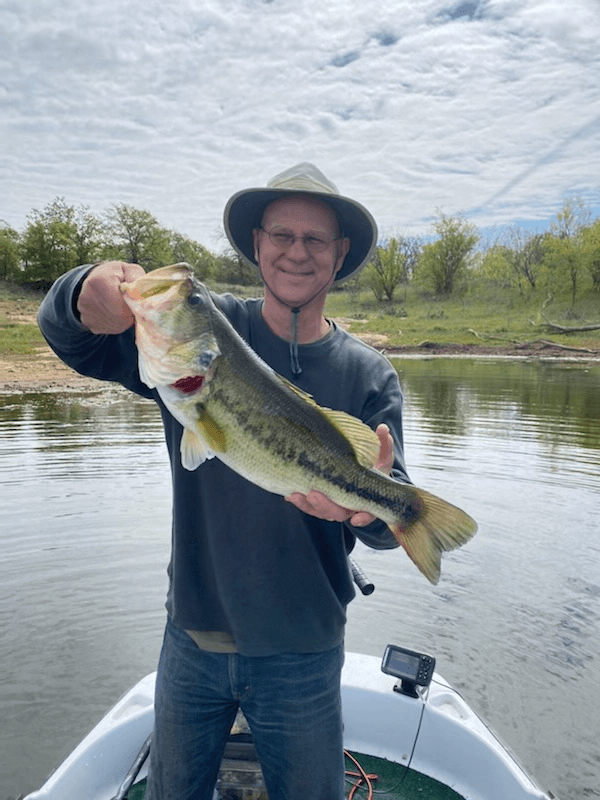

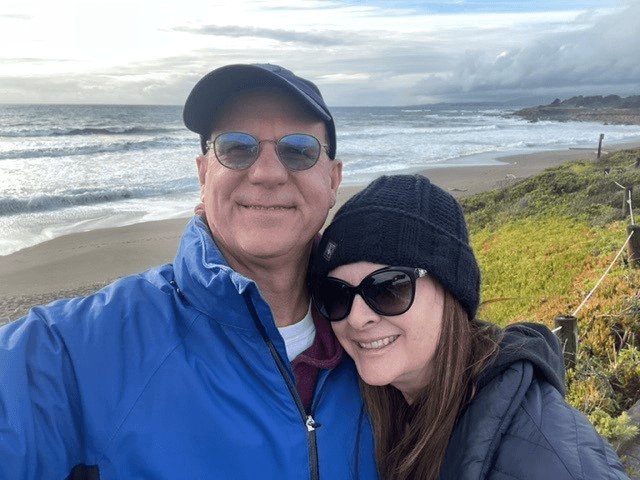

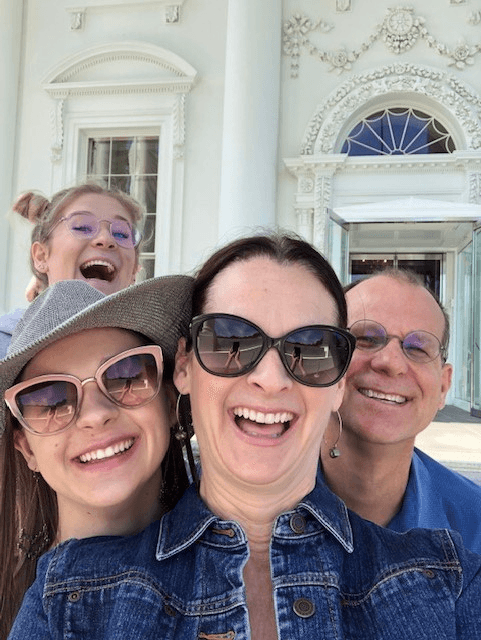

I always seemed to have an innate attraction to earning money and progressive endeavors. When I was a kid, I’d ride my bicycle down to the local Country Club and forage for aluminum cans to redeem for cash. I discovered I liked saving and I liked earning, but most of my money was spent on hobbies like dirt biking, drumming, and fishing. Those three hobbies consumed most of my time from childhood through college. I started a job when I was 15 to support my hobbies, and I’ve been working ever since. After High School, I wasn’t that interested in college, but it was important to my parents that I get a degree, so I ended up with a Finance Degree from UTA. I also worked for my uncle over the summers of ’86 and ’87, who was an entrepreneur that developed a methodology for testing electric motors. After college, I worked for a mortgage company and soon discovered that corporate life wasn’t a stimulating environment for me. I then worked for a medical supplies company in the accounting department for a few years. That company sold, and although I survived the sale to the host company, I decided I wanted to open my own business. I did so in October 1995, and although I struggled in the early years, I never looked back. Julie and I were married on December 29th, 1990, and we have two incredible daughters, Kaleigh (now 27) and Allie (now 24).

Would you say it’s been a smooth road, and if not, what are some of the biggest challenges you’ve faced along the way?

There have certainly been numerous challenges, particularly in the early years. I didn’t really know what I was doing when I purchased a printing franchise in 1995, but I felt a great sense of freedom even though I was working extraordinary hours. My accounting experience started to pay off when it was time to secure an SBA loan and run the financials for the business. Although we technically broke even fairly quickly, it was difficult to break into the next level of revenues and profits to be able to sustain my partner and me. I was fortunate that my wife was working and excelling in her career. After about 3 years, I merged the franchise with another after a failed acquisition attempt. Little did I know at the time that the shop we merged with was financially upside down. I had jumped from the frying pan right into the fire! Eventually, that company folded, so I accepted a position in sales for another printing company. That went OK, but I knew I needed to find my own way in business. Then one day a friend of mine called and asked if I may be interested in going into the commercial janitorial business. I said, “Sure”.

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

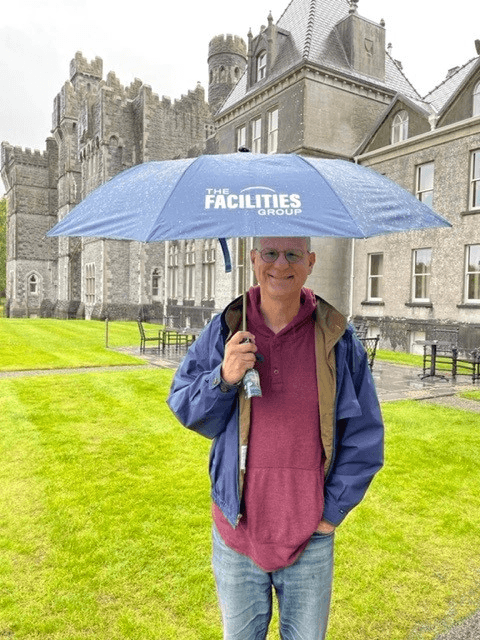

In August 2004, a friend and I founded a company called Best Facility Services. We serve the DFW area with ongoing commercial cleaning and specialty cleaning services. I was still working in sales for another company, so I moonlighted in growing and sustaining BFS while selling for the printing company during the day for about 2 years. We bootstrapped BFS with only $4,000 and never had to inject more cash or get a credit line. After making a few key hires, we gained enough momentum to make the Inc 5000 list twice, realizing steady growth for many years. Our most profitable year was during the Covid pandemic in 2020, when we pivoted by offering disinfectant services during that time. Our sales fell some but the bottom line swelled. We began attracting interest from buyers in the mergers and acquisitions market. In June 2021 we became a part of The Facilities Group by means of a sale/equity roll. This facilitated my partner’s exit and my eventual succession plan. We now have nationwide resources and can reach into many other markets. I project that BFS will continue to grow, empowered by The Facilities Group, which is now about a 700-million-dollar company.

What are your plans for the future?

In 2008, I became frustrated with the returns my savings were producing, so I decided I’d try to dabble in real estate. I purchased a single-family home at a tax sale auction in Fort Worth for $31,000.00. After months of restoration, I wanted to put it on the market, but since no one could get a loan after the loan crises, I started renting it. I decided I liked “mailbox money,” so I purchased other properties for rent over time. I was fortunate in buying the houses when I did because real estate really took off in the DFW area. We still have several rental properties, and we also now participate in syndications as passive investors in multi-family apartments. I plan on continuing to manage and expand our investment portfolio. We also purchased a ranch in Oklahoma. I thoroughly enjoy spending time there with recreation, trail riding, restoring a cabin and ranch house, planting, and fishing. This year, I built some trellis lines to start a boutique vineyard. We will likely grow other fruits as well. As I’m winding down my career with BFS, I’m finding myself busier than ever in managing investments, spending time at the ranch and other projects. Julie and I travel as well. Plus, in just a few weeks, we’re expecting our first grandbaby. That’s a significant and welcome change! I anticipate being quite busy and at some point, will likely start one or more “retirement businesses”.

Contact Info:

- Website: www.bestfacilityservices.com

- Facebook: https://www.facebook.com/mark.borge.35

- Linkedin: https://www.linkedin.com/in/mark-borge-b198426/