Today we’d like to introduce you to Aisha R. H-Jones

Today we’d like to introduce you to Aisha R. H-Jones

Hi Aisha R., so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

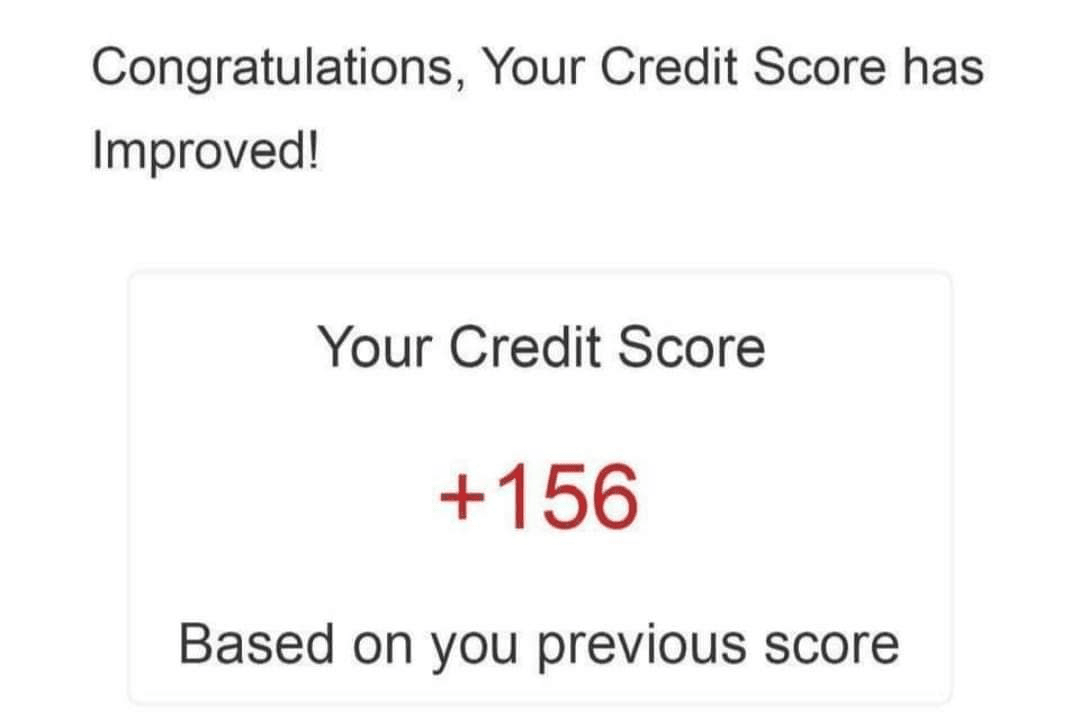

Over 20 years ago, my journey in the credit restoration industry began from a place of hardship. At 17, I was a homeless teen mom, struggling to make ends meet and facing bad credit. Denied low-income housing, I decided to take control of my financial destiny. By 23, I had purchased my first home, and since then, I’ve dedicated myself to helping others achieve the same success.

Today, my company empowers people with a deep understanding of financial literacy. As a Certified Success and Financial Literacy Coach, Author, and NLP Certified professional, I specialize in guiding individuals to discover their true potential. Through personal mentorship, I’ve helped hundreds find their path to financial empowerment and success.

My mission is clear: demystify the world of credit, promote financial literacy, and open the doors to greater financial opportunities for all. My story is a testament to the power of determination and the belief that, with the right guidance, anyone can overcome their challenges and achieve lasting success.

We all face challenges, but looking back would you describe it as a relatively smooth road?

My biggest obstacle was helping people understand that any process takes time. It was crucial for them to grasp the fundamentals not only of reaching their goals but of maintaining a healthy score. I transitioned to consulting to offer a clearer understanding of how to improve their scores.

While I had always worked a 9 to 5 job, I eventually decided to pursue entrepreneurship full-time in 2017. An opportunity to partner with a company that focused on both credit repair and financial literacy education presented itself. I was drawn to this chance to help more people. It felt like a godsend because it was about addressing the root causes of financial issues, such as a lack of budgeting and saving—things not typically taught in formal education. This understanding was vital to avoid repeating past mistakes.

This transition was significant for my business and incredibly fulfilling, as it allowed me to serve others with a greater sense of purpose.

Alright, so let’s switch gears a bit and talk business. What should we know?

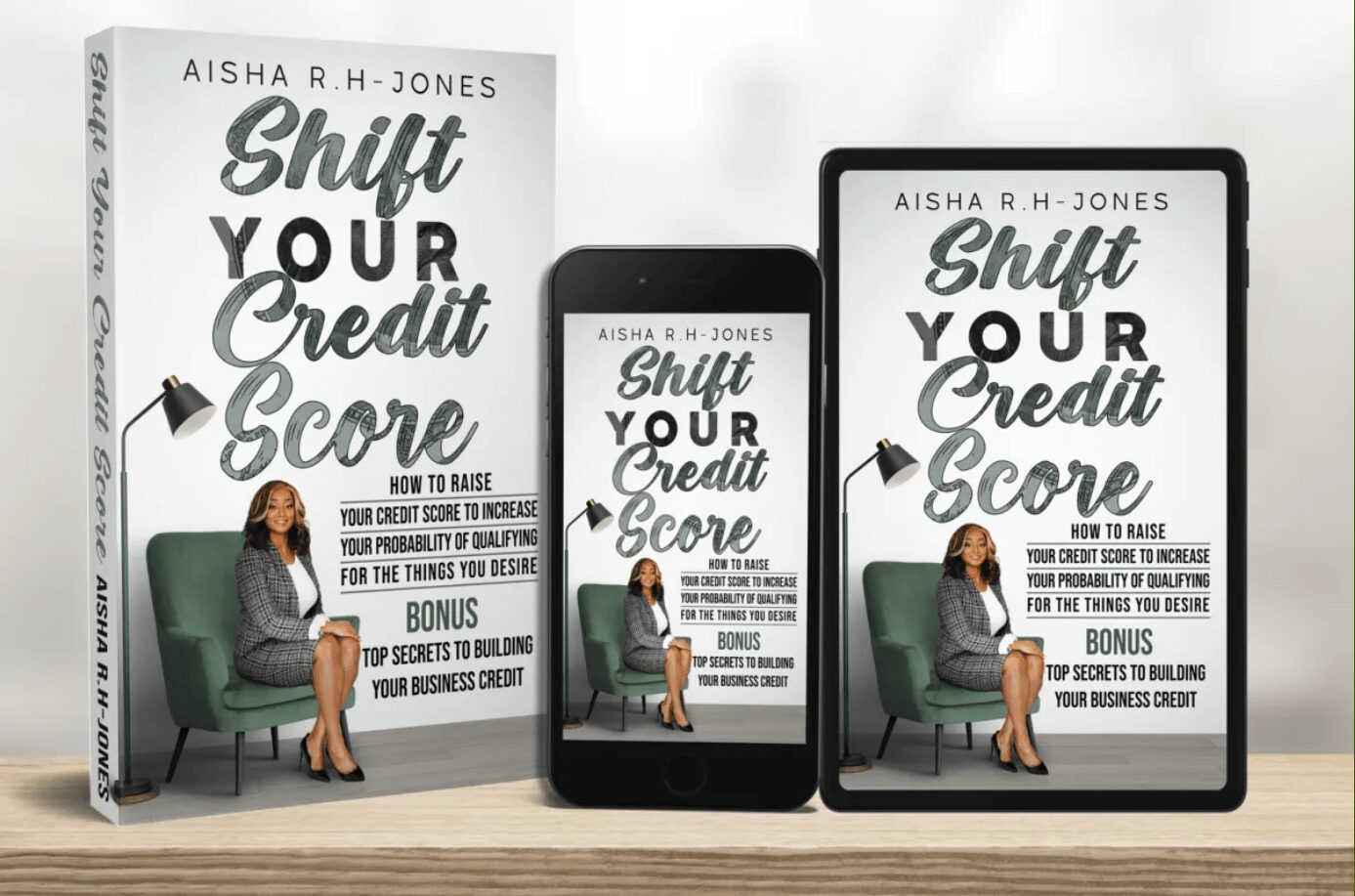

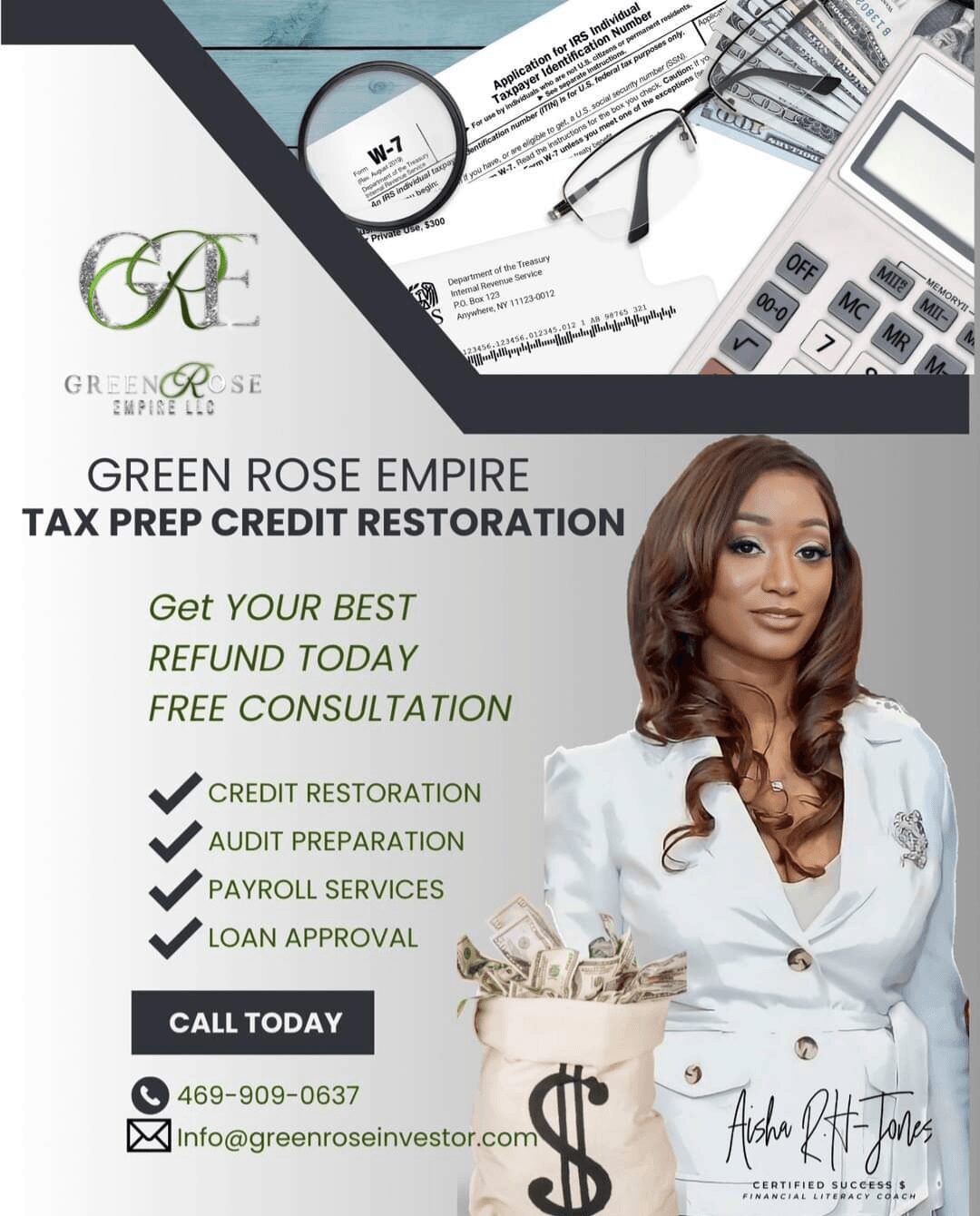

Our business focuses on financial literacy with a strong emphasis on credit repair. As a Certified Success and Financial Literacy Coach, Author, and NLP Certified professional, I aim to educate and empower individuals to take control of their financial futures, directly linking financial success to a positive mindset.

Our approach goes beyond mere credit repair; we strive to address the root causes of financial struggles, such as a lack of budgeting and saving skills, which are often not covered in formal education.

We specialize in providing comprehensive financial education and personalized consulting services. Additionally, we offer tax services and have recently incorporated solar solutions to help people save on energy costs.

What sets us apart is our holistic approach: we don’t just help you improve your credit score; we equip you with the knowledge and tools to maintain financial health long-term. Our goal is to foster lasting financial literacy, ensuring our clients are well-prepared to manage their finances independently.

We have expanded our services to include business credit, loans, tradelines, and credit monitoring. These offerings are designed to help both individuals and businesses build and maintain strong credit profiles, access necessary funding, and stay on top of their financial health.

Brand-wise, I am most proud of the profound impact we have on our clients’ lives. Seeing people transform their financial situations and gain confidence in managing their money is incredibly rewarding. Our brand stands for empowerment, education, and sustainable financial health.

I want readers to know that our offerings go beyond traditional credit repair. We provide educational resources, one-on-one coaching, tax services, and solar solutions tailored to individual needs. Whether you’re struggling with debt, looking to improve your credit score, seeking to understand personal finance better, wanting to save on energy costs, or needing assistance with business credit and loans, we are here to guide you every step of the way.

Are there any books, apps, podcasts or blogs that help you do your best?

Absolutely! I believe that a strong mindset is the foundation for success in both life and work. When you change your mindset, you change your life. I regularly read mindset books to keep myself inspired and focused. Some of my favorites include “The Game of Life and How to Play It” by Florence Scovel Shinn, “The Power of Now” by Eckhart Tolle, and anything by Neville Goddard.

In addition to reading, I also find great value in listening to podcasts that focus on personal development and financial literacy. Some of my favorite podcasts are “The Tony Robbins Podcast,” “The Secret to Success with Eric Thomas,” and teachings from Abraham Hicks.

I’m also a published author of “You Are the Shift,” a book of inspirational quotes designed to motivate and inspire readers to transform their lives through positive thinking and practical advice.

To ensure my knowledge stays current, I regularly attend training in the field of finance and mindset. This continuous learning helps me provide the most up-to-date advice and strategies to my clients.

Contact Info:

- Website: https://www.greenroseinvestor.com/

- Instagram: https://instagram.com/successwithaisha

- Facebook: https://www.facebook.com/share/tNJd7thTduNLCjfw/?mibextid=LQQJ4d

- Youtube: https://youtube.com/@aisharhjones?si=1DFaNRS9ZBAkLlgd

- Other: https://www.greenroseempire.com/

Image Credits

Otis Clayborne II