Today we’d like to introduce you to Rasya Ramakrishnan

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

As a high school student with a passion for business and technology, I constantly searched for opportunities to develop my interests and skills. While serving as the Executive Director of Frisco Ignite, a nonprofit organization, I launched Flaer, a nonprofit matchmaking platform, to mitigate an issue nonprofit directors like myself face, and this began to expose me firsthand with the challenges entrepreneurs and startups face in getting their ideas off the ground.

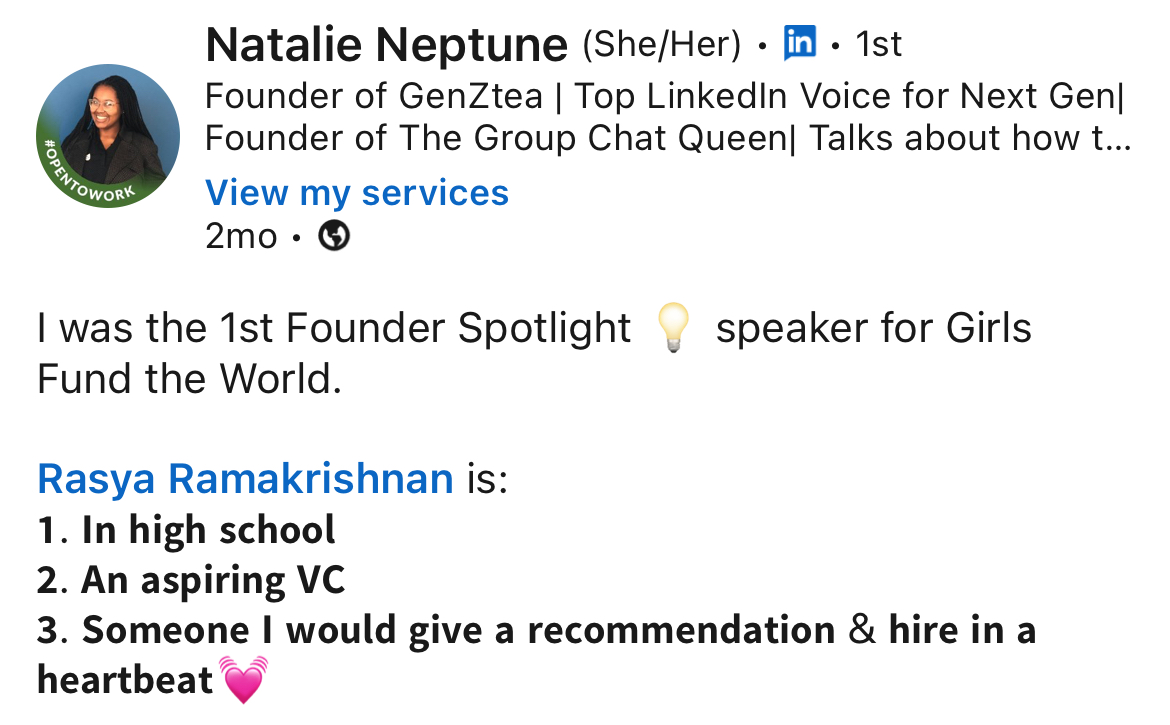

I realized that access to financing can make or break early-stage ventures. This led me to conduct an independent study focused on venture capital and how investors evaluate new companies. Eager to share this knowledge, I joined the team of Girls into VC, a program that introduces high school and college students, especially young women, to the world of venture capital through fellowships and learning opportunities. I also served as the Co-Founder & President of Young Investors Society to help people across all backgrounds receive workshop training on financial literacy.

During my independent study and talking to several VCs, I was fortunate to secure a mentor, Kat Weaver, who exposed me to the business of coaching entrepreneurs via her startup Power to Pitch, where I attend weekly calls to critique entrepreneurs and help them win investment deals by improving their pitch.

These experiences have developed my passion for the intersection of business, and technology while also working to make them more accessible to students of all backgrounds.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

The biggest challenge has been paving my own path. Running the first-ever student-led investment fund dedicated to women and integrating gender psychology into finance is life-changing. I have to ability to merge the abstractness of human behavior with the concrete, quantifiable nature of financial analysis. At just 17, navigating this new territory has been daunting, yet incredibly rewarding. It’s exciting to explore new ways to bridge the gap between psychology and finance because one day, I hope to inspire others to take novel approaches and achieve their own goals!

Appreciate you sharing that. What should we know about Girls Fund the World?

At 12, I read an article about the mere 6.6% of Fortune 500 companies with women CEOs, and I was appalled. My father pointed out that women-run companies actually have a 34% higher return on investment according to the Harvard Business Review. Inspired, I made a promise to change this narrative. For my 13th birthday, instead of typical gifts, I asked my parents to open a custodial account and they gave me $500 to start my personal stock portfolio.

To start, I began thorough research on publicly-traded, women-run companies to understand what factors shape their positive financial records. I spent many hours analyzing graphs, reading company reports, and even taking notes on the social, emotional, and psychological factors of a woman that may have contributed to their successful leadership.

Excited by the outstanding performance of my stocks, I was motivated to spread my thesis to others. I created an investment thesis report of nearly 20 pages and began advising members of my community. For my guidance, I would charge a consulting fee that depends on the size of the portfolio and the level of the price. Eventually, word about my performance as such a young advisor spread throughout my community and I received an overwhelming amount of clients, raising over $10K. Realizing that what excited me more than the revenue was the impact I was making, a mentor’s insight into the lack of funding for women-led ventures (< 2%) inspired me to start my own fund, Girls Fund the World (coined from the popular phrase, “girls run the world”), with the motto “2% is the tip of the iceberg”. In 2024, I secured LLC status, allowing me to invest in pre-seed, women-run companies. I reinvested 100% of my advisory revenue into women founders, focusing on minorities, by writing checks, marketing online, and using my VC networks to find promising entrepreneurs. After creating a stable brand, I began to feature their stories on Instagram and YouTube every Friday. After nearly five years of persistence, I am proud to have provided these essential resources to women, minorities, and student entrepreneurs, helping them succeed.

Can you tell us more about what you were like growing up?

Growing up, I was the second of four kids, and my parents called me the “glue” because I loved bringing people together. I was a bubbly extrovert with a vivid imagination and an eye for creativity. I was the quintessential girly-girl—always playing princesses, running around in my rose tulle skirt, and stacking chunky beaded bracelets up my arms. Everything I did had a touch of pink and sparkle!

Contact Info:

- Website: https://girlsfundtheworld.com/

- Instagram: @girls.fund.the.world

- Youtube: https://www.youtube.com/@girlsfundtheworld