Today we’d like to introduce you to Suhaib Elhadi.

Suhaib, we appreciate you taking the time to share your story with us today. Where does your story begin?

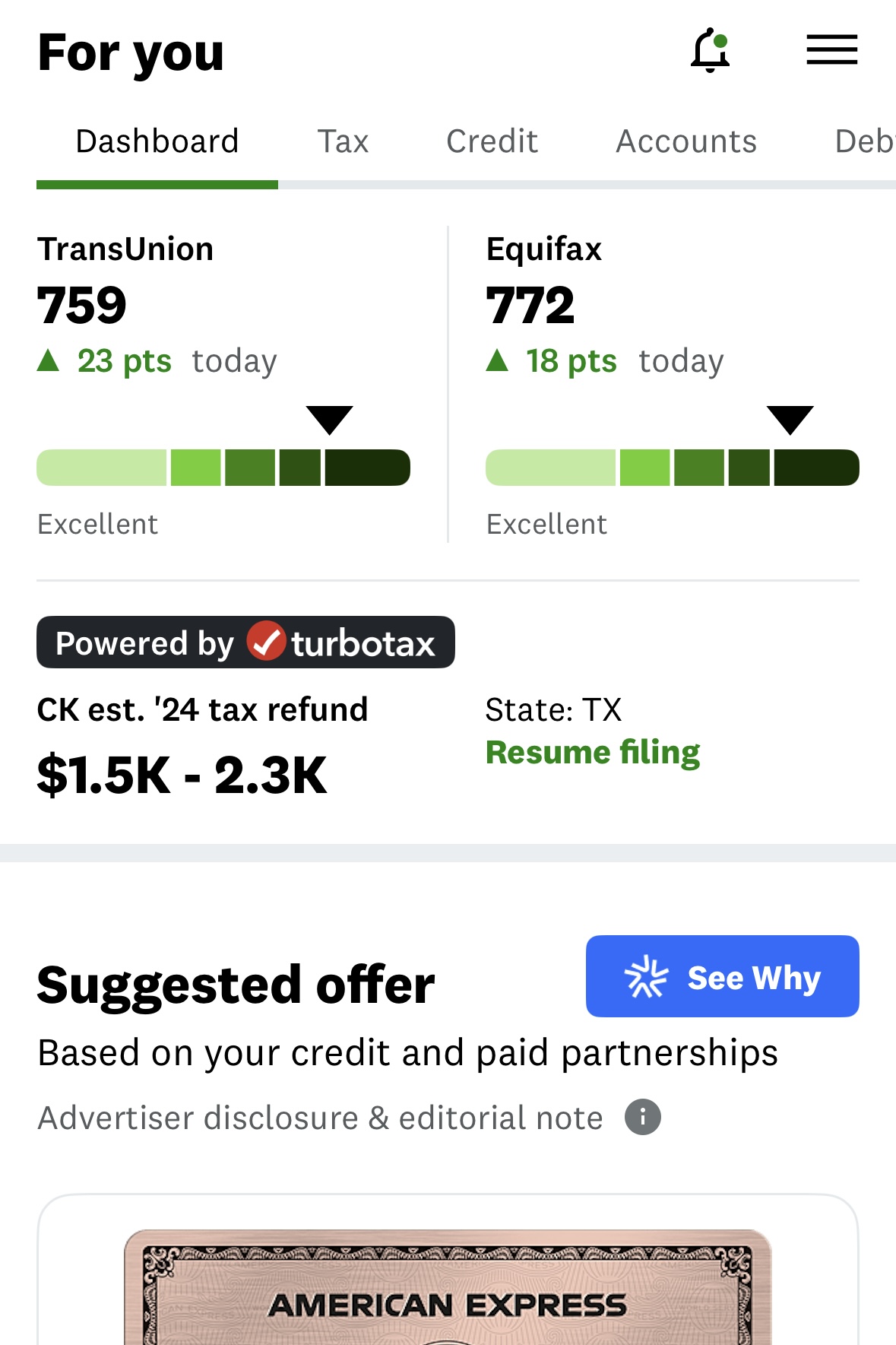

My relationship with credit started very early. At 18, I became obsessed with doing things the “right” way. While most people my age were just figuring life out, I was building my first credit profile. By the time I turned 20, I had a 740+ credit score. I felt unstoppable. That score became the foundation for my first real leap into business.

I launched my first LLC in Amazon dropshipping and used credit card stacking to secure $75,000 in funding. At that time, I felt like I had cracked the code. For the first time, I had access to real capital, real opportunity, and a real future. But what followed was the lowest point of my life as an entrepreneur.

About a year later, a business partner I trusted stole my identity and left me responsible for the entire $75,000 in debt — plus interest, fees, and damage I couldn’t even measure yet. Overnight, I went from being funded and confident to financially trapped and devastated. My credit was destroyed. My momentum was gone. And the system I once thought I mastered had turned against me.

For the next few years, I moved through different industries trying to rebuild my life. I learned network marketing. I doubled down on e-commerce. I entered the car rental and Airbnb spaces through another partnership. I learned fast—but I also learned hard lessons. Eventually, I uncovered that this second partner was scamming people, and I walked away from that too. By then, I had spent nearly three years carrying broken credit, broken trust, and the emotional weight of feeling like I had failed.

But in every single business I touched—whether it succeeded briefly or fell apart—there was one common denominator: credit was always the engine behind growth. It wasn’t marketing. It wasn’t hype. It wasn’t luck. It was credit. And yet, mine was destroyed.

That realization forced a turning point. Instead of running from the damage, I decided to face it head-on. I committed to learning the credit system at the deepest level—not from YouTube hacks, but from the law, the reporting systems, real data disputes, and firsthand trial and error. I rebuilt my own credit from the ground up — again. No shortcuts. No magic tricks. Just real method and real discipline.

That journey changed everything. I realized I had now lived every stage of the financial cycle:

building credit from nothing,

leveraging it into real funding,

losing everything through betrayal,

and rebuilding from the ashes.

At that point, starting my company wasn’t a business idea anymore—it was a responsibility.

That’s how Concentric Solutions Group was born. What began as me fixing my own credit became me helping others do what most people are told is impossible. Today, I help individuals and entrepreneurs repair their credit, structure their businesses properly, and access real funding to change their lives. Every strategy I teach is something I’ve personally lived.

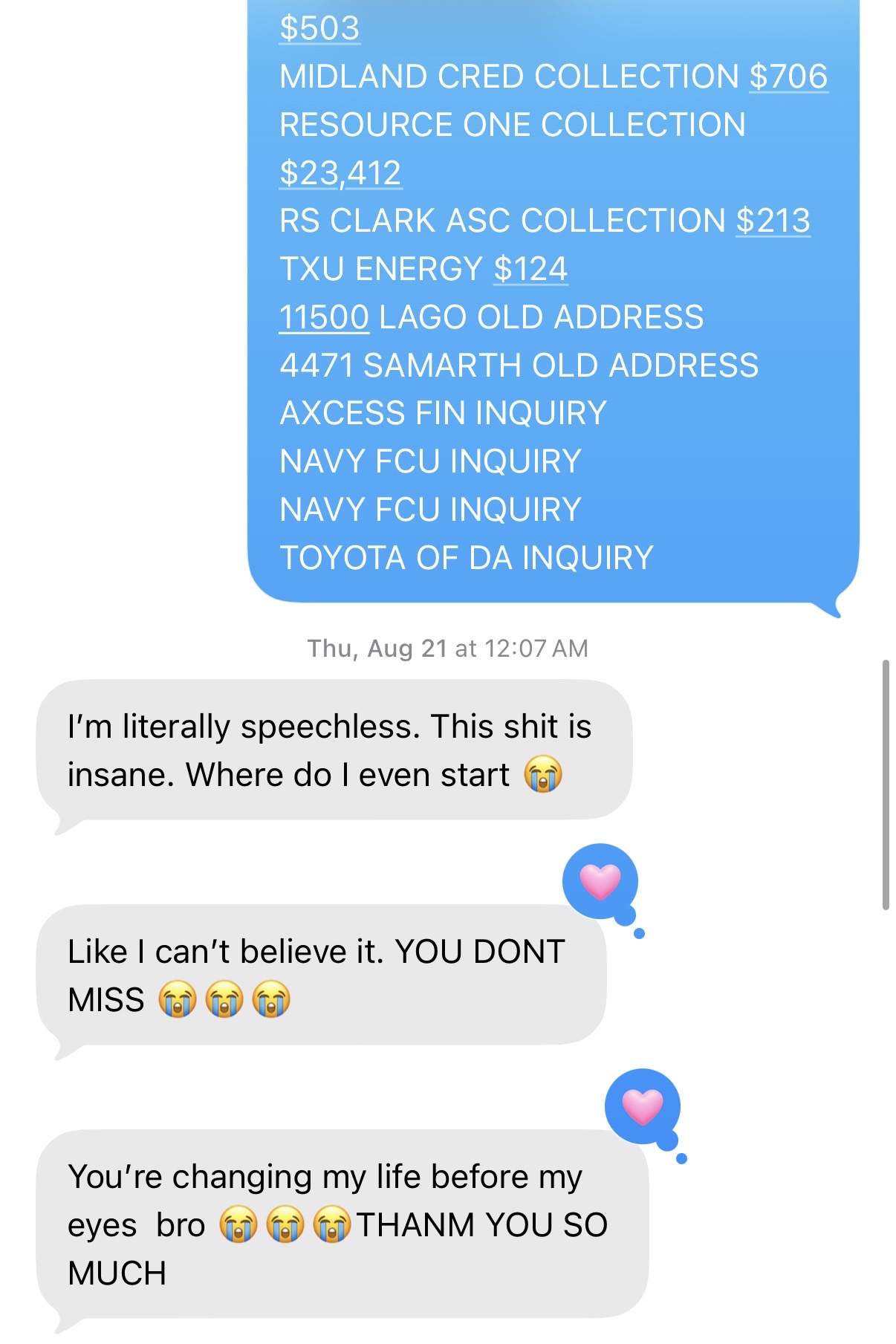

I didn’t start this business from a place of theory. I built it from pain, loss, discipline, and redemption. And now, the most fulfilling part of my journey is watching my clients win — getting approved for homes, launching businesses, securing six-figure funding, and finally feeling financially free after years of being stuck.

My story isn’t about perfection. It’s about resilience. And about proving that even when the system breaks you, you can still learn it, master it, and use it to build everything back—stronger than before.

We all face challenges, but looking back would you describe it as a relatively smooth road?

It definitely hasn’t been a smooth road. One of the biggest struggles I faced was losing everything I had built early on. After securing $75,000 in funding and launching my first business, having my identity stolen by a trusted business partner put me in massive debt overnight. My credit was destroyed, my momentum was gone, and I found myself financially and emotionally stuck.

For nearly three years, I lived with damaged credit and limited access to opportunity. When your credit is broken, the impact goes far beyond numbers—it quietly shuts doors, delays progress, and creates a constant feeling of being behind. During that time, I moved through multiple industries, including network marketing, e-commerce, car rentals, and Airbnbs, trying to regain stability. Some ventures taught me valuable lessons, while others ended after discovering unethical or fraudulent behavior from partners.

Another major struggle was navigating partnerships and learning who to trust. Experiencing betrayal more than once forced me to become far more disciplined about structure, contracts, and protecting myself in business. It was a painful education, but a necessary one.

Starting over from zero was one of the most humbling parts of my journey. Rebuilding after loss requires a level of patience and mental toughness that success alone never teaches. There were moments of burnout, doubt, and deep frustration—especially watching others seem to move forward while I was stuck recovering.

Even after launching my company, the road still wasn’t easy. Building a legitimate business meant mastering compliance, systems, client management, legal protections, and reputation—all while staying consistent through slow seasons. Growth came with pressure, responsibility, and constant learning.

Looking back, every struggle shaped the way I operate today. The setbacks taught me discipline. The losses taught me humility. And the rebuild taught me resilience. Those experiences are the foundation of how I now serve my clients—because I understand exactly what it feels like to be denied, delayed, and determined at the same time. All these trials and tribulations gave me the tools I now use to help other people break free.

Appreciate you sharing that. What should we know about Concentric Solutions Group?

My company, Concentric Solutions Group, is a financial education, credit, and funding ecosystem built specifically for people who were never taught how the credit system actually works. At our core, we help individuals and entrepreneurs repair their credit, structure their personal and business profiles properly, and access real funding to create upward mobility—not just temporary relief.

What we specialize in is full-cycle transformation. That means we don’t just help someone remove negative items and send them on their way. We educate our clients on how credit actually works, how to use it strategically, how to position themselves for approvals, and how to leverage funding for real outcomes like business launches, real estate, vehicles, and long-term wealth-building. We work with everyday consumers, aspiring entrepreneurs, and active business owners who are trying to move from survival to scalability.

What sets us apart is that our system is built from real experience—not theory. I’ve personally lived every stage we guide clients through: building credit from scratch, leveraging it into funding, losing it all through identity theft and bad partnerships, and rebuilding from the ground up. That lived experience shapes everything we do. Our strategies aren’t based on shortcuts or gimmicks—they’re based on laws, structure, compliance, and disciplined execution.

We’re also known for our education-first approach. In an industry that often thrives on secrecy and fear, we focus on transparency and empowerment. In addition to services, we offer digital courses, mentorship, community-based education, and tools designed to remove the confusion around credit and business funding. Our goal is to make our clients dangerous—in the best way possible—with knowledge.

Brand-wise, what I’m most proud of is the trust we’ve built. Many of our clients come to us after being burned by other companies or feeling hopeless about their situation. Watching them go from denial letters to approvals, from anxiety to confidence, from stuck to funded—that’s the real success metric for us. We’ve helped people buy homes, launch companies, secure vehicles, and access six-figure funding opportunities they never thought were possible.

What I want readers to know is that Concentric Solutions Group isn’t about quick fixes—it’s about building financial power correctly and sustainably. We don’t just repair credit—we rebuild confidence, access, and opportunity. Our brand stands for resilience, education, structure, and long-term transformation. And everything we offer—whether it’s a service, a program, or a resource—is designed to give people real control over their financial future.

We exist to help people stop surviving inside the system and start mastering it. At the core, our brand stands for one simple truth: your past does not get to permanently decide your future—if you’re willing to learn the rules and rewrite your position.

What matters most to you?

What matters most to me is impact—real, measurable impact on people’s lives. Everything I’ve been through showed me how quickly access can be taken away, and how long it can take to get it back. When your credit is damaged, you don’t just lose buying power—you lose confidence, options, and often belief in yourself. Helping someone reclaim that is bigger than business to me.

I care most about helping people shift from survival thinking to ownership thinking. Watching someone go from being consistently denied to getting approved for their first home, their first business funding, or their first real opportunity—that never gets old. Those moments remind me why I started.

I’m also deeply driven by truth and education. I hate how much financial information is gatekept or intentionally oversimplified. People fail not because they’re incapable, but because they were never taught the rules. Giving people clarity instead of confusion matters to me because I once needed that clarity myself.

At this stage of my life, legacy matters more than income. Income is a tool—but impact is the mission. Building something that outlives me, that continues to change families, mindsets, and futures long after I’m gone—that’s what truly matters most to me, and that’s why I do what I do every day.

Pricing:

- Economy Package (Credit Repair): $499

- Upper Class Package (Extensive Credit Repair): $1,499

- Business Coaching & Mentorship

- Starting & Scaling a Credit & Funding Company: $9,999

- Credit Resources & Community: $39/m

Contact Info:

- Website: https://go.concentricsolutionsgroup.com

- Instagram: https://instagram.com/@elhaditv

- LinkedIn: https://www.linkedin.com/in/elhaditv/

- Youtube: https://youtube.com/@concentriconvos

- Other: https://linktr.ee/elhaditv