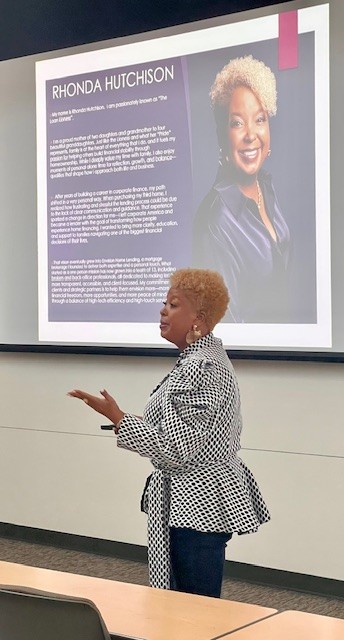

Today we’d like to introduce you to Rhonda Hutchison.

Hi Rhonda, so excited to have you with us today. What can you tell us about your story?

My journey into mortgage brokerage was not a straight line — it was a calling that unfolded over time. Early in my career, I spent years in corporate finance with FedEx Corporation, working in various financial roles that sharpened my analytical mindset, discipline, and leadership skills. While the experience was invaluable, I always knew deep down that sitting behind a desk crunching numbers wasn’t my ultimate purpose. I wanted my work to touch lives in a more personal and meaningful way.

I entered the mortgage industry with a clear mission: to educate first-time homebuyers — especially within Black and Brown communities — on how to build wealth through homeownership, navigate lending responsibly, and make informed financial decisions. Education has always been at the heart of what I do. I believed then, and still believe today, that access to clear information and trusted guidance can change the trajectory of families for generations.

After the COVID-19 pandemic, however, I began to see a growing and urgent need among senior homeowners. Many were facing financial distress due to rising living costs, medical expenses, reduced income, and lingering economic impacts. I first-handed witnessed seniors struggling financially — often without knowing where to turn for reliable guidance. That moment became a pivotal shift in my business and my purpose.

Today, as a Seniors Financial Specialist / Reverse Mortgage Specialist, my role is to educate, advocate, and provide resources for senior homeowners who are experiencing financial stress, facing pre-foreclosure or bankruptcy, need additional retirement income, or simply desire a lifestyle change that better supports their long-term well-being. My goal is not just to offer a loan product, but to deliver clarity, dignity, and solutions that align with each client’s unique season of life.

In alignment with that mission, I am also a published author of “Reverse Mortgage: 10 Myths Plaguing the Black Community.” I wrote this book to dispel long-standing misconceptions surrounding reverse mortgages and to provide a roadmap toward financial freedom through real stories, facts, and practical education. It serves as an extension of my advocacy work and reinforces my belief that knowledge empowers families to make confident and sustainable financial choices.

In 2024, I started a Mortgage Brokerage because I envisioned more- not for myself but for others (my clients, my team, my community). Launching Envision Home Lending was about more than starting a company — it was about building a platform rooted in compassion, integrity, and impact. Through strategic partnerships with attorneys, wealth strategists, real estate professionals, and community organizations, we continue to expand access to education and financial solutions across the communities we serve. Every relationship is built on trust, transparency, and a shared commitment to people over transactions.

In summary, what truly drives me personally is legacy. As a mother and grandmother, I strive to model resilience, leadership, and service. I want my daughters and granddaughters to see what’s possible when purpose meets discipline and courage. Professionally, my vision is to continue creating pathways for financial literacy, sustainable homeownership, and long-term wealth building. As the Broker/Owner of Envision Home Lending, I lead with both strategy and heart. My philosophy remains simple: everyone matters, every story deserves respect, and every client deserves solutions that support their future. The journey has taught me that true success is measured not only by growth, but by the lives we impact and the futures we help others envision.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

It has not been a smooth road. I’ve learned a lot. Building Envision Home Lending has stretched me in ways I never imagined. I have always been a leader, but stepping into ownership for the first time was a challenge. It came with real learning curves, definitely moments of uncertainty, and decisions that were based on pure faith. I trusted the steps God placed before me and continued moving forward in obedience because I knew it was more than about me. My growth continues and I know God has me every step of the way.

We’ve been impressed with Envision Home Lending, but for folks who might not be as familiar, what can you share with them about what you do and what sets you apart from others?

Envision Home Lending is a mission-driven mortgage brokerage built on education, trust, and meaningful relationships. We help our clients and strategic partners envision more — more clarity, more confidence, more opportunity, and more long-term financial stability — through a balance of high-tech efficiency and high-touch personalized service. Our approach combines innovative lending solutions with human connection, ensuring every client feels informed, respected, and supported throughout the entire process.

We specialize in serving senior homeowners as well as forward mortgage clients, with a strong focus on Reverse Mortgages (HECM), retirement-income strategies, and creative lending solutions that support aging in place, debt elimination, wealth preservation, and lifestyle transitions. We are also known for our deep commitment to education — empowering clients, families, and professional partners to make confident decisions through transparency, clear communication, and strategic guidance rather than pressure-based sales.

What truly sets Envision apart is our heart for people and our culture of excellence. Our core values — integrity, family first, professionalism, respect, fun, and walking in excellence in every part of the process — guide how we serve our clients, collaborate with partners, and build our team. We treat every transaction as a relationship, not just a file. We intentionally partner with attorneys, wealth strategists, real estate professionals, healthcare providers, and community organizations to create holistic solutions that serve the full financial picture of each client.

Brand-wise, I am most proud of the trust we have built within the communities we serve and the reputation we have earned for advocacy, education, and results. Envision Home Lending is known for meeting clients where they are, simplifying complex financial decisions, and delivering solutions that align with long-term goals and legacy planning. Our brand reflects compassion, leadership, and empowerment — and our promise is to always lead with integrity, serve with excellence, and help every client and partner envision what’s possible for their future.

Do you have any advice for those just starting out?

My advice is to never lose sight of personal production while building a business. Growth requires vision, but stability requires consistent execution. There must be a healthy balance between leading the organization and staying connected to daily performance. Personal production strengthens credibility, cash flow, and leadership perspective. When balance exists, growth becomes sustainable and scalable.

Contact Info:

- Website: https://www.envisionlender.com

- Facebook: https://www.facebook.com/rhonda.hutchison.12

- LinkedIn: https://www.linkedin.com/in/theloanlioness/