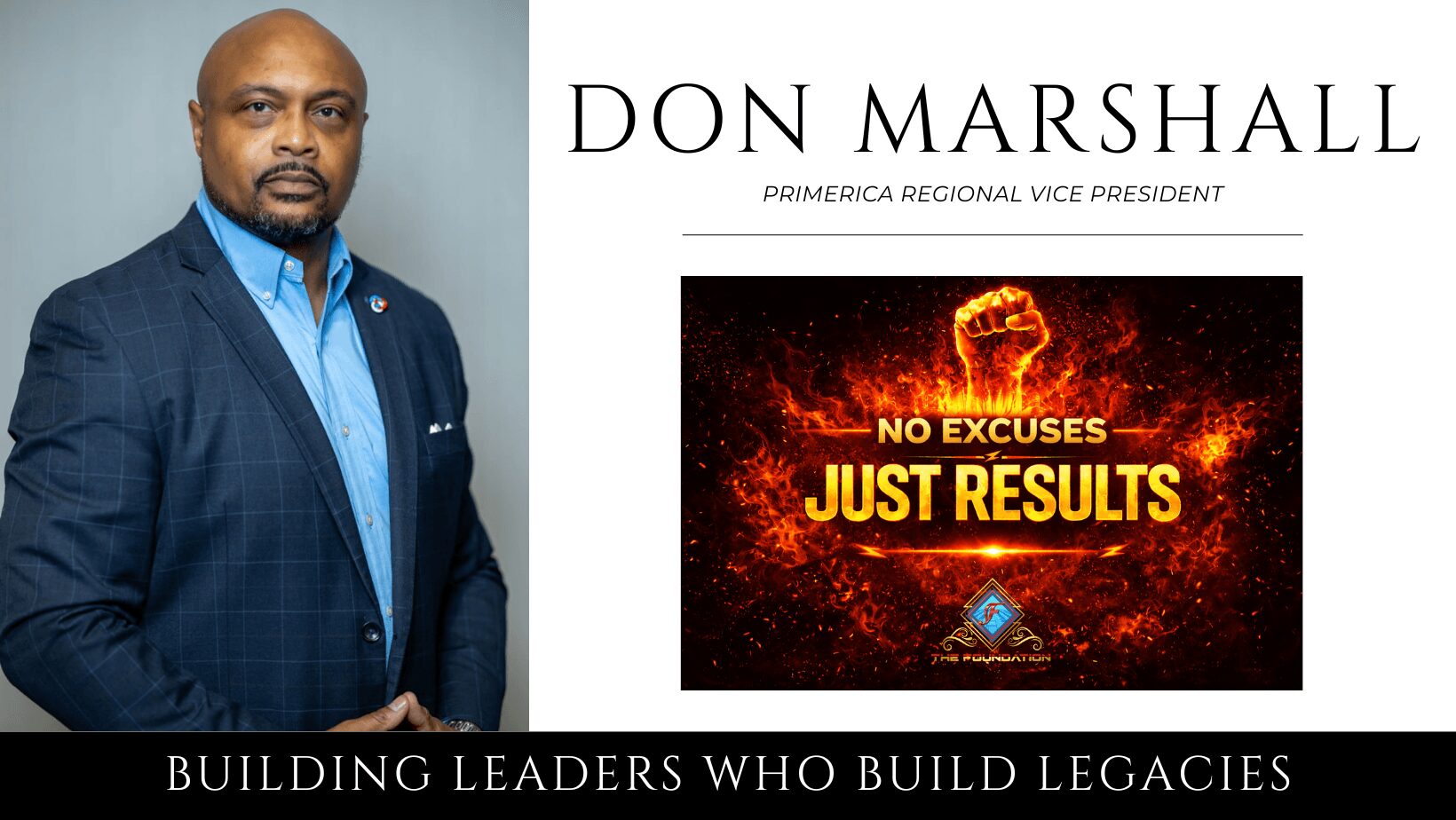

Today we’d like to introduce you to Don Marshall.

Hi Don, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

My journey has been a blend of entrepreneurship, service, and constantly being willing to learn what I thought I already knew.

Before Primerica, I worked as an IT professional. At the same time, my wife and I built and ran a personal training and boot camp facility in Arlington, Texas. We did that for over 10 years, and it taught us a lot—how to lead people, how to build a business from the ground up, how to stay consistent, and how to help others push past limitations. Like most small business owners, we learned through experience, long hours, and a deep commitment to the people we served. We truly saw it as more than business—it was a way to help people become better in every area of life.

After COVID, that chapter came to an end, but it shaped who I am. It also strengthened my faith and reminded me that seasons change, but purpose doesn’t. I’ve learned that sometimes God will close a door not to punish you, but to redirect you toward something bigger. During that same period, I joined Primerica—originally because I wanted to learn more about life insurance, investing, and basic financial principles. I didn’t come in thinking I needed a career change. I came in thinking I was just getting educated.

But the deeper I got into it, the more I realized something important: a lot of what I thought I knew about money wasn’t complete. And even bigger than that, I saw how many hardworking families were operating without real financial guidance—not because they weren’t trying, but because no one ever taught them the fundamentals. These are the kinds of principles that should be taught in schools but aren’t.

That realization changed my perspective completely. It gave me a desire to help educate people who are willing to learn—so they can protect their families, build real stability, and create long-term options instead of living on financial autopilot. To me, it’s about stewardship—helping people manage what they’ve been given wisely so they can live with confidence and build a legacy.

Today, I’m grateful I get to combine my background in structure and systems from IT, my experience in coaching and leadership from fitness, and my passion for financial education into work that truly impacts lives. What started as “I want to learn” turned into “I want to help others learn too”—and I believe that assignment is what has brought me to where I am now.

I’m sure it wasn’t obstacle-free, but would you say the journey has been fairly smooth so far?

Not at all—it hasn’t been a smooth road, but it’s been a meaningful one.

One of the biggest challenges was learning how to fully transition from one identity to another. When you’ve spent years building something—like our fitness facility—and then a major event like COVID changes the landscape, you’re forced to adapt fast. Closing that chapter wasn’t easy. It was emotional, it was financial, and it was a mental shift. You must grieve what you built while still having the discipline to build what’s next. There were moments where I had to lean heavily on my faith and remind myself that setbacks don’t mean you’re off track—sometimes they’re part of the process. I’ve learned that pressure can either break you or build you, and I chose to let it build me.

Another struggle was entrepreneurship itself. Whether it was fitness or financial services, there’s no guaranteed paycheck, no instant results, and no shortcuts. You’re dealing with consistency, self-doubt, and the pressure of keeping things moving even when life is happening around you. There were seasons when progress was slow, and I had to stay committed even when I couldn’t see the payoff yet.

In financial services specifically, a challenge was helping people see the value of education before they see the results. A lot of families want financial change, but they don’t always understand the steps it takes to get there. So, part of my growth has been developing patience, communication, and learning how to meet people where they are while still leading them forward.

Overall, the road has had its ups and downs—but every struggle sharpened me. It built resilience, it built character, and it made me better as a leader. Looking back, I can honestly say I’m grateful for the challenges, because they strengthened my mindset and my faith, and gave me the confidence to know I can handle whatever comes next.

Appreciate you sharing that. What else should we know about what you do?

Today, I work in financial services and specialize in helping individuals and families build a stronger financial foundation through education, strategy, and follow-through. A lot of people think financial planning is only for the wealthy, but my focus has always been on everyday working families, business owners, and people who are serious about improving their financial situation but need a clear plan to do it.

What I’m known for is making the complicated feel simple. I take topics like life insurance, investing, debt elimination, and long-term planning and break them down in a way that’s practical and easy to understand—because most people weren’t taught these principles in school. I also work with clients who want to create generational stability and move from “getting by” to building real financial confidence.

I’m most proud of the impact. Helping a family get properly protected, helping someone start investing for the first time, helping people become more financially disciplined—that matters. And for me, it’s deeper than finances alone—because financial stress can affect marriages, parenting, mental health, and peace at home. When you help a family stabilize financially, you’re often helping them breathe again. I’m also proud of the leadership side of what I do. I enjoy mentoring and developing others who want to grow professionally and personally and helping them step into a higher level of confidence, consistency, and performance. I believe leadership is service, and I take that seriously.

What sets me apart is that I don’t just talk money, I teach people how to think. My background in IT gave me structure and systems, and my experience owning a fitness business taught me how to coach people through change. Financial growth is like physical transformation: it takes discipline, repetition, and guidance. I bring that same coaching approach into financial space.

At the end of the day, I’m not here to sell people something—they can do anywhere. I’m here to educate, empower, and help people execute on a plan that makes sense for their life. I believe this work is purpose-driven, and I’m grateful to play a part in helping families build stability, protection, and legacy.

What quality or characteristic do you feel is most important to your success?

For me, the most important quality behind my success is discipline.

Talent is great, motivation comes and goes, but discipline is what keeps you consistent when life gets busy, when results are slow, and when you’re not feeling inspired.

Discipline is what helped me build a business for over a decade, navigate major changes after COVID, and continue growing into a stronger leader in financial services.

And I’d also say faith plays a big role in that discipline—because when your “why” is rooted in purpose, you don’t quit when it gets hard. You stay consistent because you believe what you’re building matters.

Discipline keeps me focused on the long game—showing up every day to serve people, educate families, and build something that lasts. I’ve learned that consistent effort beats occasional intensity every time, and discipline is the difference between people who talk about success and people who build it.

Contact Info:

- Website: https://www.primerica.com/donmarshall

- Instagram: https://www.instagram.com/rvpdon?igsh=ZDVyc3c4a2h6OTVh

- Facebook: https://www.facebook.com/rvpdon

- LinkedIn: https://www.linkedin.com/in/donaldmarshall