Today we’d like to introduce you to Shayan Parikh and Keon Attarha .

Hi Shayan Parikh and Keon Attarha, please kick things off for us with an introduction to yourself and your story.

Our journey into financial literacy education began with a noticeable gap in our school district’s curriculum. We recognized that financial literacy was not offered, and all economics courses were restricted to the 12th grade, which we felt was far too late for students to learn essential life skills.

To address this issue, we, along with our peers Raymond Zhang and Aryan Chilakamarthi, who are now freshmen at UT Austin, started a local finance and economics club at Jasper Junior High School, Shepton Junior High School, and later at Plano West Senior High School. Our mission was to bring basic financial education into classrooms, filling a crucial void in our core curriculum. While students learn vital subjects like math, science, and English, they often miss out on practical skills such as budgeting and saving money—skills that nearly everyone will need in adulthood. We believe that financial literacy is a crucial life skill that is best learned at a young age.

This commitment led us to establish the National Finance Economics Collective (NFEC), formerly known as GDFEC, to advocate for financial literacy in the DFW area and beyond. Today, we remain dedicated to our vision, collaborating with organizations like Bank of America, NuMinds Enrichment, JPMorgan Chase, and others to bring financial literacy education to over 10,000 underserved and disadvantaged students in Texas and across the country. Our efforts even extend internationally, with a partnership in Lebanon through the aforementioned NuMinds Enrichment.

Alright, so let’s dig a little deeper into the story – has it been an easy path overall and if not, what were the challenges you’ve had to overcome?

It has definitely not been a smooth road. Starting a non-profit organization is challenging in itself, but doing so as high schoolers presents an even greater set of obstacles. In the beginning, we faced significant struggles, particularly because many financial literacy organizations are adult-led and have established credibility. We often found ourselves competing against these organizations, which made it difficult for us to gain recognition.

There were countless instances where we were ghosted by community centers, professors, and potential sponsors, even after having engaged conversations with them. As we became more established, we still encountered resistance due to perceptions of us as “immature” high schoolers who couldn’t add any value.

Recognizing the need for a change in our approach, we took several steps to improve our outreach. We focused on enhancing our website and social media presence, elevating both to a professional standard. Focusing on an expanded curriculum, which is our selling point as an organization, we needed to work extra hard due to us not having the initial credentials as high schoolers to deliver a world-class and comprehensive set of slides for all finance economics topics. Our VP of Curriculum, Emory Yi, has been absolutely instrumental to our success, leading this initiative with remarkable vision and dedication. Her efforts helped us establish several key partnerships with organizations, showcasing the value of our newly-built modules and elevating our impact in the community. For these partnerships, we found that going in person to meetings and events also made a significant difference in establishing connections and gaining credibility.

Thanks for sharing that. So, maybe next you can tell us a bit more about your work?

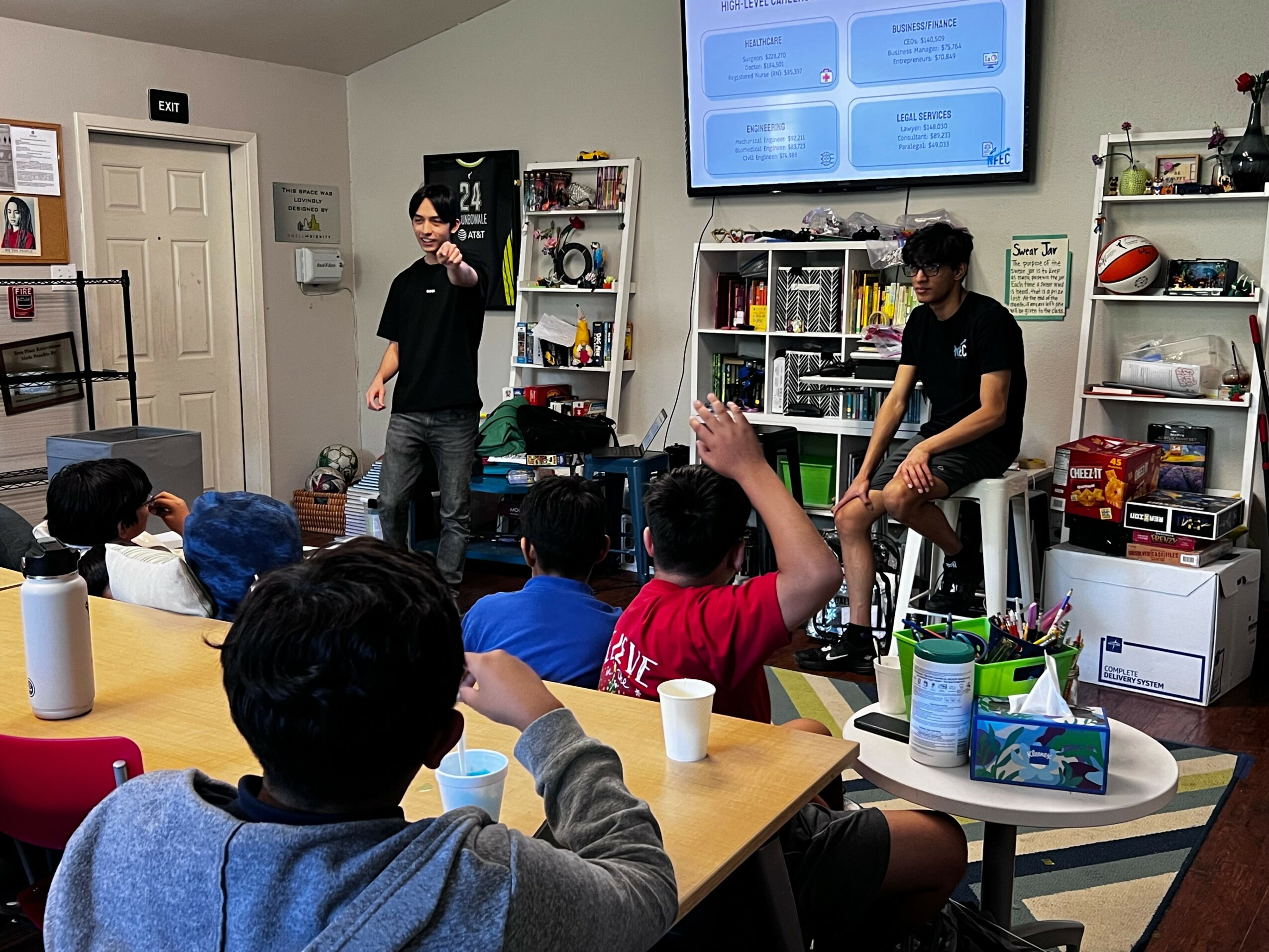

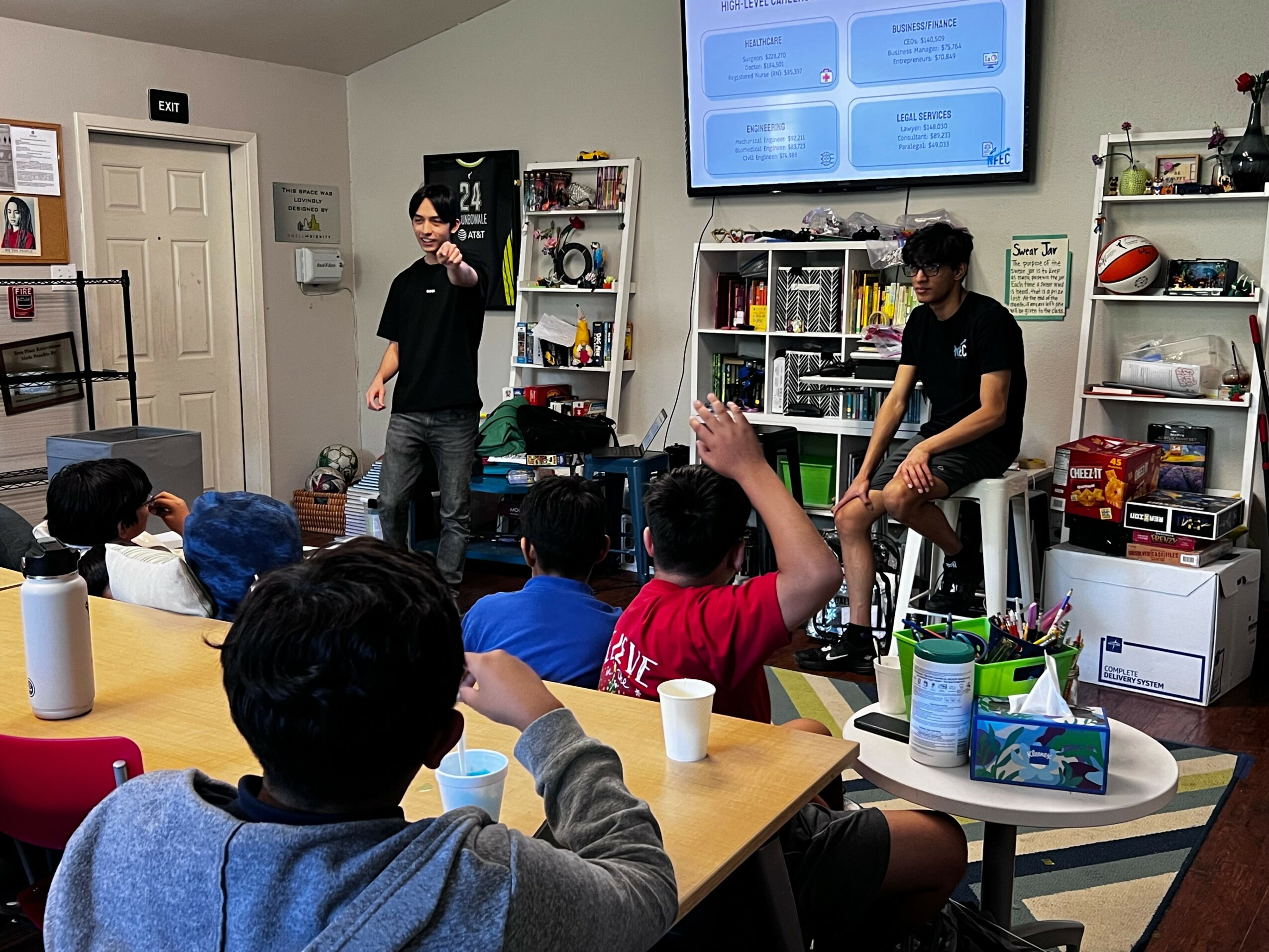

We are a dedicated group of high school students working to bring comprehensive finance and economics education to immigrant and underserved youth across the United States. Put simply, NFEC creates interactive financial literacy curriculum for the students that need it the most. Our curriculum consists of over 70 slide decks covering 5 key topic areas: Intro to Finance, Global Economics, Investing & Banking, Financial Services, and FinTech. This curriculum aims to provide a strong foundation for a potential career in the finance industry and for making smart financial decisions in everyday life. What specifically makes our curriculum so special is that it is explicitly tailored to elementary and middle school audiences, with fun collaborative activities and mock competitions embedded in every lesson. This way, all of our students are actively invested and motivated in their learning.

Ultimately, we at NFEC are most proud of the fact that we take a direct, personal role in our teaching. Building this human connection with each and every one of our students has undoubtedly taken time, but nothing has been more rewarding. From receiving high fives at the end of each lesson to our unique special nicknames we get from the kids (“Uncle Sam”, “LeBron”, etc.), the personal relationships we’ve built through our workshops will endure long into the future—in both the hearts of our students and ourselves.

Are there any books, apps, podcasts or blogs that help you do your best?

Absolutely, we rely on several valuable resources that help us excel in our work. One of our primary tools is Canva, which we use to create graphics and social media posts. Canva allows us to design professional and visually appealing content that enhances our credibility and engagement with our audience.

Additionally, we utilize Google Slides and Google Docs for our in-house curriculum materials. Both platforms provide a wealth of tools that enable us to create engaging and visually appealing presentations and any supporting documents. Google platforms in general make it very easy to have collaboration among our team members, making it easier to refine our curriculum and ensure it meets the needs of our students.

Pricing:

- All of our services are free! Feel free to check us out at nationalfec.org,

Contact Info:

- Website: nationalfec.og

- Instagram: https://www.instagram.com/nationalfec/

- Linkedin: https://www.linkedin.com/company/national-finance-and-economics-collective/

Image Credits

Jubilee Park Plano Day School Sumehra Mahmud