Today we’d like to introduce you to Jacqueline Crider.

Hi Jacqueline, thanks for sharing your story with us. To start, maybe you can tell our readers some of your backstory.

I didn’t take the straight road to where I am at all. I was late-diagnosed ADHD, a rule-breaker by nature, and for years I tried to squeeze myself into boxes that never fit—societal rules, family expectations, even traditional financial advice. I chased the “right” path, and sure, I had some success on paper. But inside? I was frustrated, exhausted, and unfulfilled.

At 40, I hit my breaking point. I realized I could no longer live by anyone else’s rules. I had to drown out the noise, stop chasing cookie-cutter formulas, and figure out what financial freedom on my terms looked like and what that meant for myself and my business. That was my wake-up call.

I’d already spent countless hours studying how money actually works—the back end of mortgages, the psychology of financial success, the mindset and neuroscience behind why some people thrive while others stay stuck. And when I started blending those insights with a more intuitive, personalized approach, everything shifted.

I launched PBJ Mortgage in 2020, right as the world turned upside down. While navigating my own personal storms—market crashes, a miscarriage, two employees walking out, and my daughter’s premature birth with 47 days in the NICU—I refused to quit. I rebuilt, pivoted, and created Financial Mastery Simplified to partner and pair with it so others could finally escape the one-size-fits-all financial trap I feel like society pushes on them.

Today, I’ve helped thousands of clients achieve homeownership—many who thought it was impossible. I’ve written bestselling books, been featured on magazine covers, and built frameworks like the Financial Instinct Framework and Financial Reset Blueprint that empower women and professionals to stop feeling guilty for breaking “the rules” and instead create money plans that align with who they really are.

Would you say it’s been a smooth road, and if not what are some of the biggest challenges you’ve faced along the way?

Not even close. My path has been anything but smooth.

The Market Shifts: I opened PBJ Mortgage in 2020, right when the pandemic flipped the world upside down. The mortgage industry went from chaos to rollercoaster overnight. Housing prices spiked, rules changed constantly, and clients were terrified. Then it shifted again as the reverse happened with interests rates nearly doubling, the market slowing to a crawl, and inflation going through the roof. Instead of quitting, I doubled down on simplifying the process so families could still achieve homeownership.

Personal Loss & Resilience: Around the same time, I suffered a miscarriage. It was devastating. Just as I was processing that, I found out I was pregnant again—and my daughter was born over 8 weeks early. She spent 47 days in the NICU fighting to thrive. I was running a business, caring for a preemie, and holding my family together all at once.

Team Challenges: While my baby was in the NICU, two employees quit with little notice. Imagine juggling hospital visits, sleepless nights, and trying to keep a brand-new business afloat without the team I thought I could count on. That was trial by fire, and it forced me to become a stronger leader.

Identity Struggles: Before all this, I spent years trying to follow the rules—traditional financial advice, societal expectations, even what my family thought was “right.” And yet, no matter how hard I tried, I felt stuck and unfulfilled. It wasn’t until I admitted that I needed to do life my way that things started to change.

What I Learned

Those struggles taught me three things:

Resilience isn’t optional—it’s the muscle you build in the hard seasons.

There is no single “right” way. The financial industry loves rigid formulas, but I proved that blending traditional principles with personalized approaches works better.

You can rise even when it feels impossible. If I could keep a business alive during NICU visits, loss, and chaos—then anyone can find a way forward.

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

At the heart of everything I do—whether it’s through PBJ Mortgage or Financial Mastery Simplified—is one driving belief: your financial life should align with who you are and what you actually want, not what the world tells you to want.

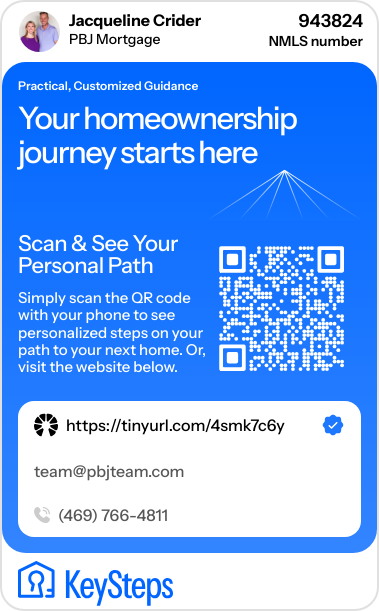

PBJ Mortgage takes the stress and confusion out of homebuying, we make it simple. As simple as, you guessed it, a peanut butter and jelly sandwich. And yes, we get you the loan—but more importantly, we make sure the loan, the home, and the financial path you’re stepping into truly align with your bigger goals. From FHA and VA loans to creative options like DSCR and bank-statement loans, we meet people where they are while challenging them to think about the why behind their choices.

Financial Mastery Simplified is where mindset meets money. It’s not about budgets for the sake of budgets, or rigid formulas that make you feel like you’re failing if you don’t fit the mold. It’s about resetting your financial blueprint so every decision—from saving to investing to spending—lines up with your values and long-term vision.

What Sets Us Apart

Alignment & Intentionality. We don’t just “check the boxes” or nod along when someone says, “This is what I want.” We ask deeper questions: Is this truly what you want—or what you’ve been told you should want? That challenge is what creates breakthroughs.

Meeting You Where You Are. We honor your current season of life—whether you’re buying your first home, recovering from financial setbacks, or ready to build wealth. But we don’t leave you there. We push you to grow, with the tools and clarity to do it on your terms.

A New Standard in Finance. In an industry that often just processes paperwork, we’re known for creating space to pause, reflect, and ensure that decisions are intentional—not reactive.

What I’m Most Proud Of

I’m proud that our brands stand for permission and empowerment. Permission to define success for yourself. Empowerment to make decisions that are truly aligned. In a space where too many professionals let people run headfirst into decisions without asking the hard questions, we stand apart because we care enough to challenge. Not from a place of judgment, but from a place of believing you deserve to build a life that actually fits you.

Bottom line: We don’t just help you get the mortgage, or build the money plan—we help you create alignment between your finances and the life you actually want to live.

What makes you happy?

I live for the ah-ha moments. When someone finally feels seen, when the lightbulb goes off, when they realize they’re more powerful than they thought—that fills me up. I’ve always had a knack for really seeing people, pulling out the greatness in them they didn’t even know was there. Watching someone step into their own alignment, confidence, and freedom? That’s joy for me.

On the personal side, animals are my heart. My dogs are basically my children in fur coats, and if I wasn’t allergic to cats, I probably would’ve been a vet (true story). Books and writing have also been lifelong loves. I was the kid who could spend all day lost in stories, which makes it a little funny that I turned out to be so extroverted now.

In my work, podcasting is one of my greatest joys. It allows me to connect with people in a way that multiplies impact—sharing new perspectives, aligning with like-minded leaders, and creating conversations that help both me and my listeners grow. I never knew how much I’d love it until I started, and now it’s a cornerstone of my business.

Family is everything. My four daughters are incredible humans, and whether we’re cooking, playing games, or traveling, those are the moments I treasure. Cooking is creativity + connection—two of my favorite things. And traveling? That’s my way of constantly learning, exploring new cultures, tasting new foods, and seeing the world through fresh eyes.

At the end of the day, happiness for me is about connection—whether it’s with people, animals, ideas, or experiences. If it helps me grow, helps others feel seen, or brings people together, that’s where I find joy.

Pricing:

- Financial Instincts Framework- $1997 (3 month full reset program)

- Fast Track Financial Freedom Toolkit- $27

- Mortgage 101: The Secret Sauce to Homebuying- $9.99

- HouseU: the Fundamentals of Buying a Home- $297

Contact Info:

- Website: https://www.pbjteam.com

- Instagram: https://www.instagram.com/jaxcrider/

- Facebook: https://www.facebook.com/jax.crider/

- LinkedIn: https://www.linkedin.com/in/pbj-mortgage-jacqueline-crider/

- Twitter: https://x.com/pbjmortgage

- Youtube: https://www.youtube.com/@pbjteam and https://www.youtube.com/@FinancialMasterySimplifi-vr2wp

- Other: https://urals.co/jax-crider

Image Credits

Bold Social