Today we’d like to introduce you to Donnell & Shaerica Walder

Today we’d like to introduce you to Donnell & Shaerica Walder

Hi Donnell & Shaerica, so excited to have you with us today. What can you tell us about your story?

Our story truly began in March 2020, right when the pandemic started. We found ourselves at rock bottom—our credit was far from great, and we were running low on finances. It was in this tough moment that we decided to take control of our destiny. As pastors of WOW Church Global a growing church based in Tyler, Texas, which has now expanded to Shreveport, Dallas, Nairobi, and even Pakistan, we realized we had to lead differently and break the mindset of poverty.

We began by focusing on our credit, educating ourselves about credit laws, and taking action. Through hard work, we raised our credit scores from very low levels to the high 700s. We didn’t stop there. We turned around and offered to help our community and church by repairing their credit for free. This led to so many blessings for others—people were able to purchase homes and cars, changing their financial outlook completely.

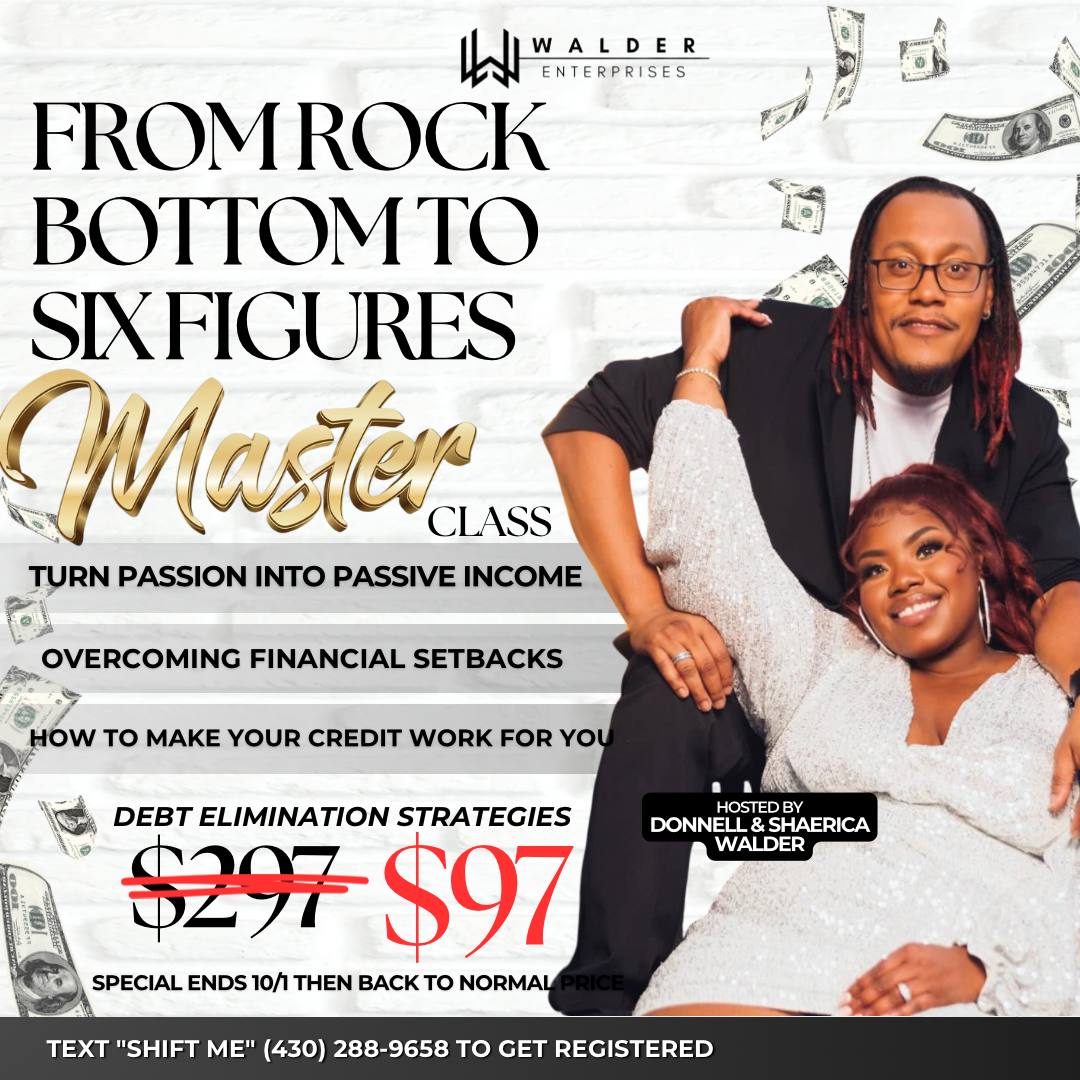

What started as a desire to bless our community evolved into a business. We launched as Another Chance Credit Education Services, which quickly became a five-star reviewed company on Google. As we continued to grow, we transitioned into Walder Enterprises, with a focus on bridging the gap between faith and finances. Our mission is to show people that they have the power to create wealth. We’ve gone from rock bottom to six figures, and now we’re helping others do the same—teaching them how to turn their passion into passive income by understanding credit and leveraging credit laws to build the future they desire.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way. Looking back would you say it’s been easy or smooth in retrospect?

It definitely hasn’t been a smooth road. Like any journey, ours was filled with challenges. One of the biggest struggles was starting at rock bottom with poor credit and limited finances. It felt overwhelming at times, and there were moments when it seemed like no matter how hard we tried, the progress was slow.

Another challenge was leading a church during the pandemic. As pastors, we were responsible not only for our personal growth but also for guiding and supporting our congregation through uncertain times. Expanding our church to other locations like Shreveport, Dallas, Nairobi, and Pakistan added even more pressure. We had to balance our ministry responsibilities with the desire to break the cycle of financial struggle in our own lives.

Educating ourselves about credit laws and navigating the complexities of credit repair was another hurdle. There were countless hours of research, trial and error, and moments of doubt. But through faith and persistence, we kept moving forward.

On top of that, as we began offering free credit repair to our community and church, managing the growing demand became a challenge in itself. Eventually, we had to learn how to turn this service into a sustainable business while maintaining our passion for helping others.

Despite the difficulties, we kept our faith strong and pushed through, knowing that the struggles were part of our testimony. Each challenge along the way prepared us for the growth we’ve experienced today.

We’ve been impressed with Walder Enterprises , but for folks who might not be as familiar, what can you share with them about what you do and what sets you apart from others?

Our business, Walder Enterprises, is all about bridging the gap between faith and finances. We specialize in credit education, credit repair, and financial empowerment, but what sets us apart is our focus on combining biblical principles with practical financial strategies. We believe that people have the power to create wealth, and we’re committed to teaching others how to leverage their credit and financial opportunities to build a secure future.

We started as Another Chance Credit Education Services, and as we grew, we rebranded to Walder Enterprises to reflect our broader mission. Our services go beyond just fixing credit scores—we’re known for truly empowering our clients with knowledge about credit laws and showing them how to use those laws to their advantage. We offer personalized coaching, credit analysis, and tools that help individuals and families not only improve their credit but also learn to maintain it.

What sets us apart is our holistic approach. We integrate faith into our financial teachings because we understand that financial health is deeply connected to overall well-being. Our clients know us for our genuine care, integrity, and transparency, and many have come to us not only to fix their credit but to transform their financial mindsets.

Brand-wise, we’re most proud of the lives we’ve helped transform. We started at rock bottom ourselves, so we understand the struggle firsthand. We’ve been able to turn our own challenges into a brand that helps others turn their passion into passive income, buy homes, and even start businesses. We’ve been blessed to expand our reach beyond our local community to international locations, and that’s something we’re extremely proud of.

For anyone reading this, we want you to know that Walder Enterprises is here to support you on your financial journey. Whether you need help with credit repair, education on credit laws, or a complete financial makeover, we’re here to provide the tools and guidance you need to succeed. Our goal is to empower you to break free from financial struggles and walk into the abundance that’s available to you.

Do you have any advice for those just starting out?

For anyone just starting out, my biggest piece of advice is to stay persistent and patient. Building anything—whether it’s your credit, a business, or a new life path—takes time, and there will be moments when you feel discouraged. Don’t let setbacks stop you from moving forward. We wish we had understood sooner that failure is part of the journey. Every mistake we made along the way taught us something valuable that helped us grow.

We also wish we had known more about the importance of credit laws when we first started. Understanding the laws around credit is a game changer—it’s what helped us turn our financial situation around. If you’re working on your credit, educate yourself as much as possible, and don’t be afraid to ask for help.

Another important lesson is to build a strong support system. Surround yourself with people who believe in your vision and will encourage you to keep going, even when things get tough. Whether it’s a mentor, a coach, or a community of like-minded individuals, having people to lean on makes all the difference.

Lastly, remember to lead with faith and integrity in everything you do. When you stay true to your values, doors will open that you never imagined. Your journey might not look exactly how you planned, but trust that the process will lead you exactly where you need to be.

Pricing:

- Credit Repair Services: • Initial Setup: $150 down • Monthly: $65 per month • Special Offers: Occasional promotions for clergy and couples

- Credit Vault Mentorship Program: • $87 per month • Includes monthly coaching sessions, credit analysis, step-by-step instructions to help reach the 700+ credit score club, credit monitoring, financial planning tips, customized dispute letters, access to the next Money Moves Master Class, and one-on-one calls.

- Phlebotomy School (Online and Self-Paced): • Total Cost: $750.00 • Down Payment: $300.00 • Payment plans available

- Level Up Strategy Session with the Walders: • Pricing varies by session, please inquire for details.

- We offer personalized services, so we always encourage potential clients to reach out for specific pricing tailored to their needs

Contact Info:

- Website: https://www.walderenterprises.com/

- Facebook: https://www.facebook.com/walderenterprises?mibextid=LQQJ4d