Today we’d like to introduce you to Eric Boshart.

Hi Eric, so excited to have you with us today. What can you tell us about your story?

I graduated film school from UCLA in 2016 and started working on the finance side of the industry, investing in independent film through various debt instruments. With my immediate family growing in the DFW metroplex, I knew my time in Los Angeles was coming to a close. While working remote in DFW for the same firm, my brother and I started flipping homes. We “learned on the job” as they say, getting some wins under our belt and also gaining valuable investment experience. Halfway through 2022, the interest rate environment changed drastically, and around that time I officially left my job in LA. Serendipitously, an old childhood friend of my brother’s was interested in getting into hard money lending after flipping homes himself. Using some startup capital, our combined experience flipping, and my experience in private credit in the media & entertainment space, we started lending, and the business quickly took off. We launched the fund in February of 2024 and have steadily grown since. We’ve positioned ourselves as a local, boutique lender with excellent servicing and flipping know-how.

Alright, so let’s dig a little deeper into the story – has it been an easy path overall and if not, what were the challenges you’ve had to overcome?

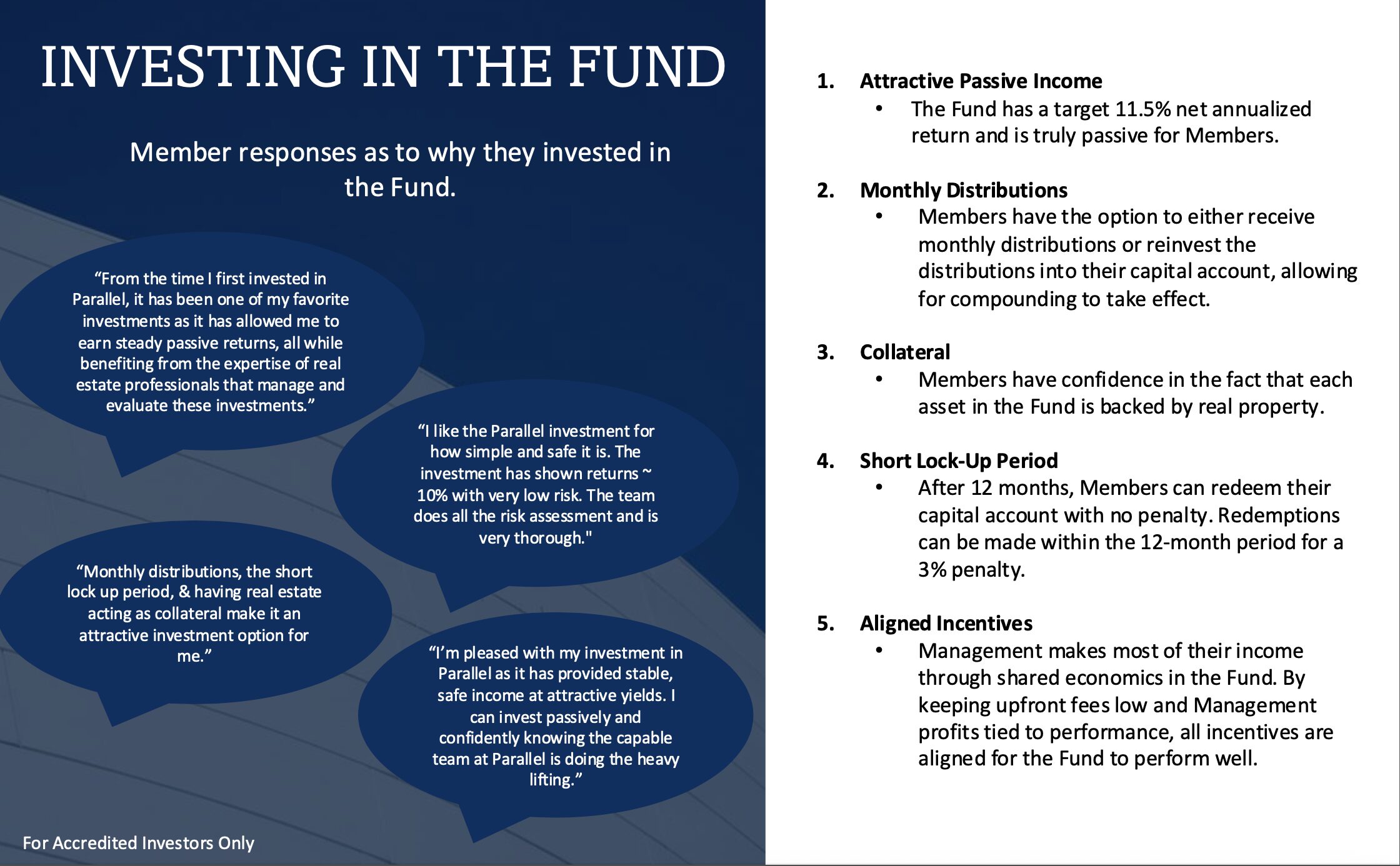

It hasn’t always been a smooth road. Hard money lending is always this push and pull of having enough capital for deals and enough deals for the capital that you’ve raised. So you’re constantly trying to find the right balance there. It’s all about investing our LPs’ capital securely and protecting their capital at all costs. With that comes a lot of pressure to deliver solid risk-adjusted returns. Because a lot of the capital is personal and/or friends and family, it becomes paramount that we maintain a good product.

While we haven’t had any foreclosures to-date, we definitely have had “problem children” in the fund that we’ve had to implement creative solutions for. They take up a lot of head space. We’ve also been presented a lot of shiny objects that we’ve had to say no to, which can be difficult when you the advertised returns but is rewarding at the end of the day. We just have to maintain a high degree of discipline at all times and make sure that our focus is singular. Stay in your lane, be a one trick pony, hit singles and doubles. The flashy stuff usually has some hair on it.

Appreciate you sharing that. What should we know about Parallel Lending?

Parallel Fund I, LLC is a hard money lending fund that specializes in providing short-term, majority 1st-lien investment loans backed by single-family real estate primarily in Texas, specifically in the DFW metroplex. Through proprietary origination and underwriting, we fund quality investment real estate projects with skilled operators. We offer three products: Fix & Flip, Ground-Up Construction, and Bridge.

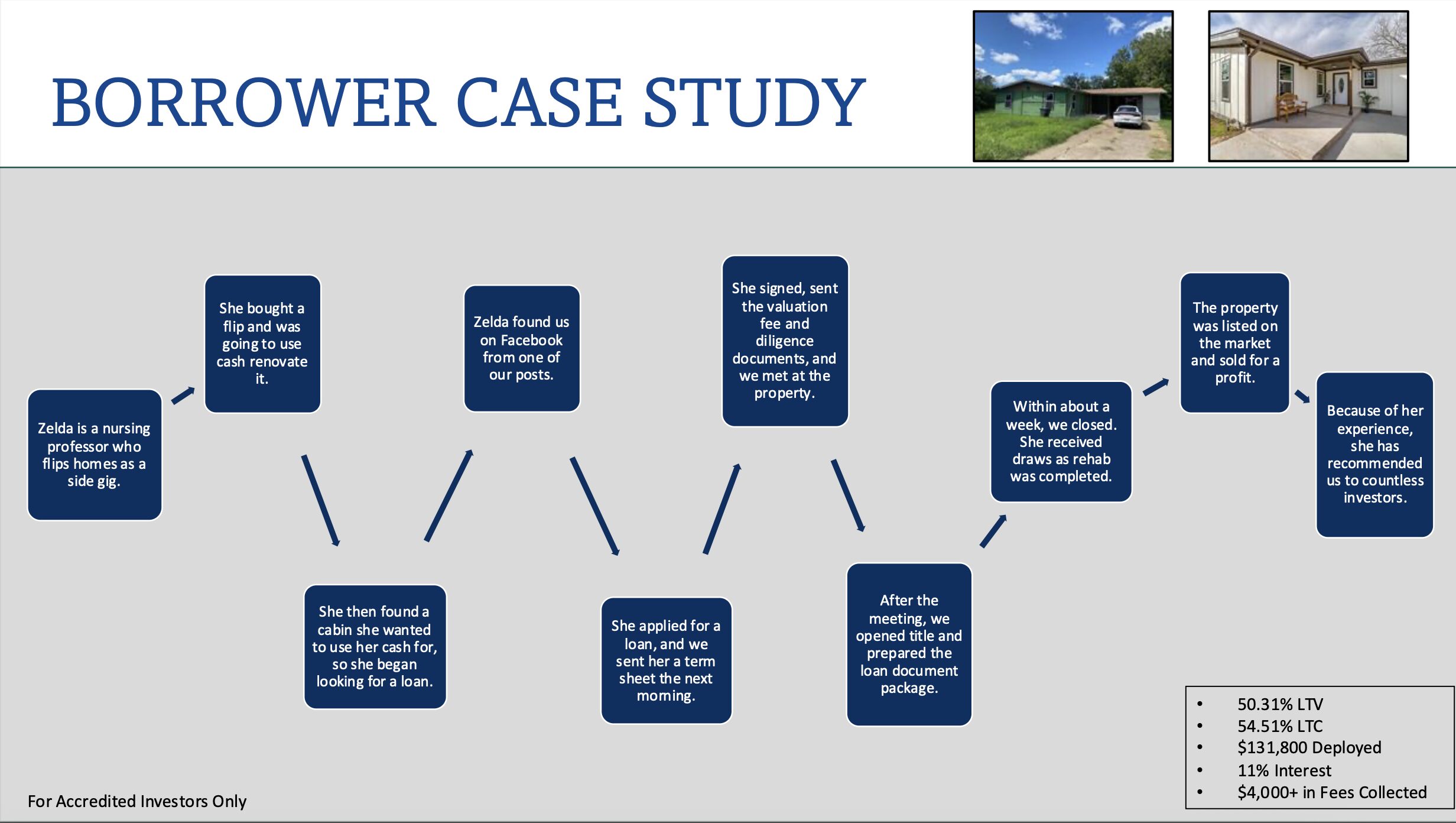

Ultimately, we’re known by our investors as guys that will do whatever it takes to preserve their capital. I think that’s what we take the most pride in. On the borrower side, we take a more qualitative approach to lending. We love to meet with our borrower face-to-face, and through the personal relationship we have with them, we know what is going on with the property, what may affect the status of the loan, and how we can be helpful. We chose Parallel as our name because we aim to run parallel to our borrower on their journey to financial freedom.

Alright so before we go can you talk to us a bit about how people can work with you, collaborate with you or support you?

Feel free to email me at eric@parallellending.com or visit our site at parallellending.com. We’d love to be a resource.

Pricing:

- Free evaluation of a possible deal

Contact Info:

- Website: www.parallellending.com

- Instagram: @parallellending

- Facebook: https://www.facebook.com/profile.php?id=100085471050382

- Linkedin: https://www.linkedin.com/company/parallel-lending/?viewAsMember=true

- Twitter: https://x.com/ParallelLending

- Youtube: https://www.youtube.com/@ParallelLending365