Today we’d like to introduce you to Sean Hyman.

Alright, so thank you so much for sharing your story and insight with our readers. To kick things off, can you tell us a bit about how you got started?

I grew up poor in south Arkansas and knew I didn’t want a life of poverty so it was going to be up to me to figure out “the whole money thing” and how to grow it. So, I knew I’d likely need to learn about stocks and/or real estate. Stocks intrigued me the most, and they allowed me to get started with smaller sums of money than real estate investing. (Later on, I ended up doing both in time).

So, when I was around 20 years old, I started picking up things like Money magazine and Kiplinger’s Personal Finance magazine, etc., and I’d read any books I could find in the bookstores. I also know I wanted to fast-track my progress so I made it my goal to get a job at a stock brokerage firm. That was a great feat in itself since the industry had just gone to a requirement of having a bachelor’s degree to qualify and I didn’t have one. So, it was literally a miracle of God that I got an interview, found favor with an HR rep, and got my shot with Charles Schwab in Orlando.

Later on, I became a manager over a team of brokers and obtained more financial licenses. I’d also, later on, gained forex/currency trading experience through a forex broker that I worked for, FXCM.

Over time, I knew I wanted to further separate myself out from the pack, and so that led me into the financial publishing world. I started off with Agora’s Sovereign Society and later on went to Newsmax and then the Maven and ultimately where I am now, self-publishing my own newsletters on my own to my subscriber base.

Through these publishers, I’d also go on CNBC, Fox Business, Bloomberg TV, etc., and give TV interviews on the stock market, economy, commodity market, currency market, etc. It was a great experience and allowed me to broaden my exposure and help a lot of people along the way.

Today, my goal is to help my subscriber base to learn (the easy way) what I had to learn the hard way, over time. As they lean on my experience in what stocks to buy/sell and why…they’re able to avoid all of the novice mistakes and instead make investing decisions like a pro since they can lean on my 30+ years of watching markets vs their own limited experience with them.

Can you talk to us a bit about the challenges and lessons you’ve learned along the way? Looking back, would you say it’s been easy or smooth in retrospect?

No, for instance, when I was trying to get my first job as a stockbroker, I was sending resumes all over America and got rejection letter after rejection letter because I didn’t have the bachelor’s degree. Yet, I knew it was a desire of my heart, and I knew, some way, somehow, that God would open a door…and He did! It was just my job to be consistent and persistent throughout the process to give Him something to work with. So, we can never quit because of how we may feel about a situation. Success comes through being consistent/persistent. So, I hope that inspires someone who may be now where I was then. There’s hope!

In another instance, when I was interviewing to be a manager (team lead manager) for Schwab, my teammates were looking at me and laughing at me in the interview because I was trying out for the manager position in year three, and most people had been there eight years before going into management. Well, as it turned out, I got the job and doubled my income in a day, again because I didn’t worry about what others said or thought and just “went for it” anyway. Never let others hold you back, and certainly don’t let your own feelings or thought processes hold you back. We’ve only got one life to live. We might as well see what we’re made out of and go for it!

Great, so let’s talk business. Can you tell our readers more about what you do and what you think sets you apart from others?

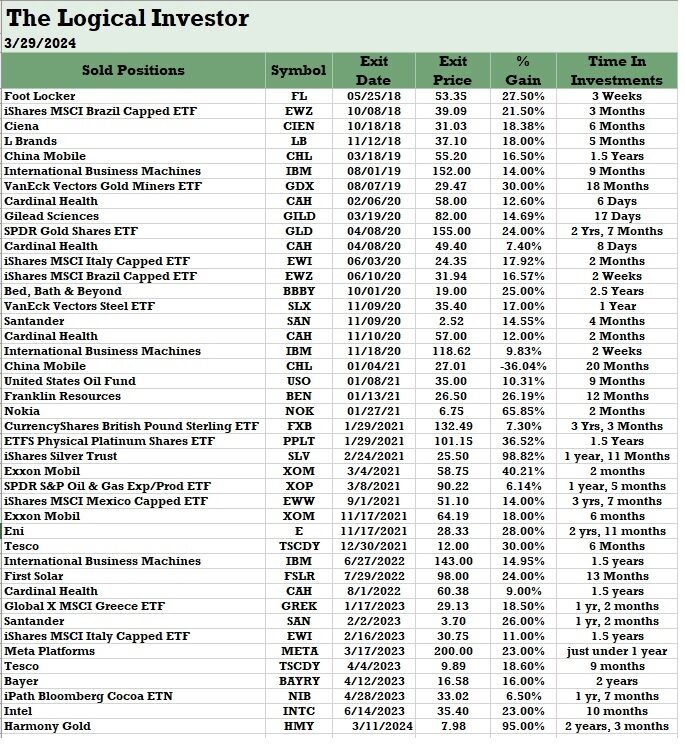

At www.logicalinvestor.net I write stock market newsletters to a base of subscribers all around the world. Just regular moms and pops, who many times don’t have much experience in stocks, OR who’ve tried and not done all that well on their own. They follow me and my investing system, and I tell them what stocks to buy and when to sell them and why we’re in them and exiting them, etc. and it greatly enhances their stock returns over what they’d have gotten themselves, going off of their own experience. So, I love that my monthly newsletters, weekly videos, and our daily forum interactions on the site give them a chance to gain a lot more knowledge, which empowers them and changes the trajectory of their investing future and, thus, the direction of their net worth!

I’d say what separates me from the pack the most is that I look at investing firstly from a Christian perspective, and I don’t hold back in sharing biblical principles that we follow in our investing. I’d also say another thing that sets me apart is the 30 years of watching markets and all of the mentors and books I’ve gotten to read all throughout those years that’s made me a pro at several forms of market analysis (fundamental analysis, technical analysis, sentiment analysis, Elliott Wave analysis, etc.). I also have a background not only in stocks but also in commodities and foreign currencies. So, I can use that knowledge in those other markets to give us an edge in the stock market.

For instance, I will have a view on oil that tells me where gasoline prices are headed and how that will weigh upon the economy or aid it, etc., and that helps me to know if we’ll have the wind to our back in the market or if the market is facing a headwind, etc.

My knowledge of the currency market tips me off to moves that will happen in stocks due to the dollar falling or euro rising, etc. So, these are all clues that I get that many stock market guys don’t get just because they don’t have backgrounds in those other additional markets.

While my monthly stock market newsletter is my main service at logicalinvestor.net, I also have a stock trading service on that site too as well as an options trading service as well (where we can take advantage of dives lower in the stock market and actually profit in and from those dives lower in the stock market).

Have you learned any interesting or important lessons due to the Covid-19 Crisis?

Yes, that the Federal Reserve allowed interest rates to go too low during this period, and they kept them too low for too long, and that spurred a lot of the inflation that we’re seeing today.

Also, economies practically shutting down and supply chains being disrupted created their own challenges and opportunities for companies. We profited nicely throughout that period because of our proven investing system, but it was certainly a unique period in time that I had nothing to compare it to. So, I thank God for a tried-and-true and steady investing system, even during weird periods in time like that.

The COVID period also taught me the need for people to make sure that they have another source of income that’s outside of their primary income/job, such as building up a passive income stream through our dividend stocks, so that they have some income coming in that doesn’t depend on them working or making as much as they normally do because sometimes we go through shaky periods in the economy and that can really dent one’s income.

Pricing:

- My investing newsletter, the Logical Investor, is $19.97 per month, no contract.

- My stock trading service, Stock Insights, is $180 annually.

- My options trading service, Options Insights, is $297 annually.

- I also have have various e-books and reports on the site that range anywhere from $5 up to $159.

Contact Info:

- Website: www.logicalinvestor.net

- Instagram: https://www.instagram.com/logicalinvestor/

- Facebook: https://www.facebook.com/sean.hyman

- Linkedin: https://www.linkedin.com/in/sean-hyman-70151911/

- Twitter: https://twitter.com/Sean_Hyman

- Youtube: https://www.youtube.com/channel/UCgDmpveqg_WJ1ZAP__iXoEw

- Other: https://www.threads.net/@logicalinvestor