Today, we’d like to introduce you to Chaz Knight.

Hi Chaz, so excited to have you on the platform. So before we get into questions about your work life, maybe you can bring our readers up to speed on your story and how you got to where you are today.

20 years ago, after a decade in the Radio Industry, I met a legal and compliance executive from Experian who became my mentor as I began my career in the credit industry. I studied consumer law. And eventually became a consumer advocate. Over the years, I have managed a couple of credit restoration companies, and now I’m the CEO of EditMyCredit in Dallas, TX. I currently work with real estate and mortgage professionals nationwide, improving clients’ credit scores so they can qualify for home loans.

Alright, so let’s dig a little deeper into the story – has it been an easy path overall, and if not, what were the challenges you’ve had to overcome?

The road to success is a long one, however, I’ve always been one to be able to adapt to my surroundings and make the most out of any situation. Of course, there were rough days, weeks, and even months, but an important lesson I learned through this journey is to stay consistent. Don’t let the highs take you too high, and don’t get too low during the lows. The secret to success in this industry is how you deal with relationships; You want to foster the good ones and walk away from the bad ones.

Appreciate you sharing that. What should we know about EditMyCredit?

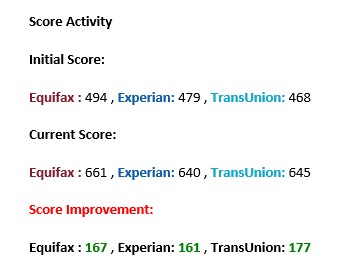

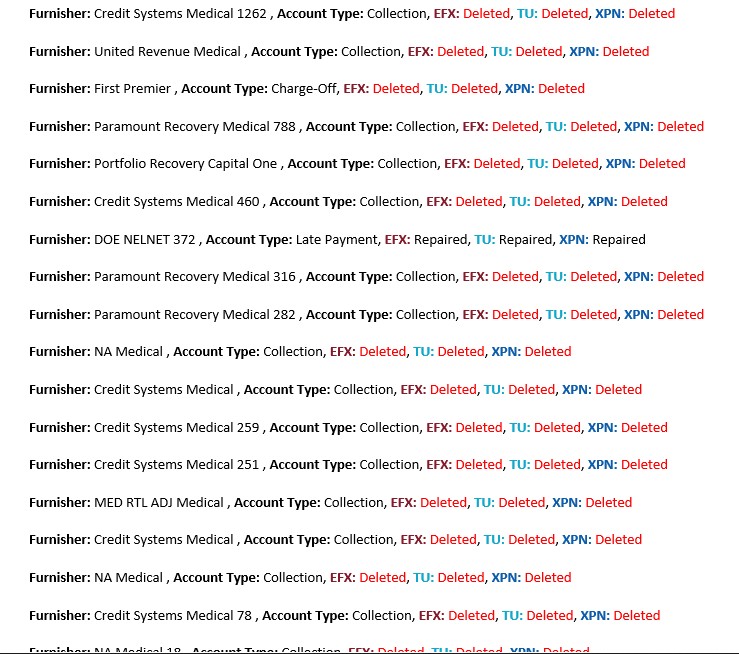

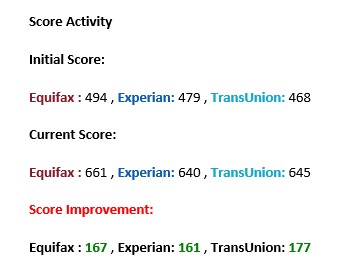

We offer a mortgage-based solution rather than just consumer credit repair. Our Forensic Credit Correction system is specifically designed to maximize credit scores as quickly as possible. We accomplish this by doing complete credit report audits and disputing all negative accounts on all three credit bureaus at once. We also address all companies individually with legal document demands to prove the accounts belong to the consumer and substantiate exactly what’s being reported. We send cease and desist demands to companies that are not complying with consumer laws and file complaints with the Consumer Financial Protection Bureau against companies that violate consumer rights. We also partner with a Consumer Law firm to settle debts and file lawsuits on our client’s behalf. We offer different levels of service, including Do it Yourself” credit repair, Hybrid Credit Counseling, and Complete Credit Restoration for home buyers.

How do you define success?

When a client gets approved for a home loan!

Pricing:

- Free Credit Counseling

- Free Credit Report Analysis

- DIY Credit Repair $39 a month

- Hybrid Credit Counseling $69 a month

- Complete Credit Restoration $99 a month

Contact Info:

- Website: www.EditMyCredit.net

- Instagram: https://www.instagram.com/editmycredit/

- Facebook: https://www.facebook.com/editmycredit/

- Linkedin: https://www.linkedin.com/in/1knight/

- Twitter: https://twitter.com/EditMyCredit

- Youtube: https://www.youtube.com/@editmycredit

- Other: https://www.tiktok.com/@editmycredit

Image Credits

Chaz