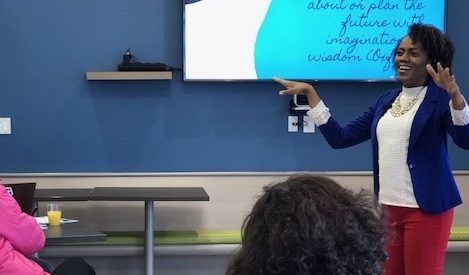

Today we’d like to introduce you to Shehara Wooten.

Shehara, can you briefly walk us through your story – how you started and how you got to where you are today.

I am a career changer. I graduated with a B.S. in Electrical and Computer Engineering and my first job out of college was with an industrial manufacturing firm, serving in various roles from engineering to sales. After some deep soul searching, praying and reading Purpose Driven Life and What Color is Your Parachute, I took a leap of faith and decided to leave that company to pursue my purpose, which is helping women and STEM professionals craft their amazing financial success stories.

When I was a STEM professional, I was saving and maxing out my 401k. However, I had a suspicion that there was more to be done. Fortunately, my church at the time offered financial literacy workshops, and my dad sent me financial literacy programs from authors like Robert Kiyosaki. I learned so much and wondered why I hadn’t learned these concepts before! From that point on, I was determined to share my newfound knowledge with others. In 2004, I joined a global financial services company and never looked back.

Five years later, I decided to pursue a role as a financial advisor so that I could help individuals and families improve their financial position in a bigger way. With some time in the profession, I began to realize that there was a limit to who I could help. If you didn’t already have assets, you were mostly on your own until you accumulated assets. If you were younger and didn’t have an inheritance or something like that, you would likely get passed over by a well-meaning financial advisor. This didn’t sit well with me and I wanted to help people craft their amazing financial success story regardless of their age or amount of assets.

I realized there was another way. By becoming a fee-only fiduciary financial planner, I could help gainfully employed women and STEM professionals who hadn’t quite accumulated the assets required to work with a traditional financial professional access solid financial planning. That was the birth of Your Story Financial, LLC, a virtual fiduciary boutique firm.

We’re always bombarded by how great it is to pursue your passion, etc – but we’ve spoken with enough people to know that it’s not always easy. Overall, would you say things have been easy for you?

Entrepreneurship is not for the faint of heart and I’ve had my share of ups and downs. I believe the toughest part for me was getting used to the income fluctuation that often comes with entrepreneurship opposed to a 9-to-5 corporate job. However, the benefits of having my autonomy and creating something that I was truly proud of far outweighed that sacrifice. I learned to rely on God as my source and understand that He is my Provider. Once I was at peace with that, I knew nothing could stop me!

I also surround myself with like-minded professionals both in and outside of my industry. Having business owners around me who know what I am going through has been truly motivational and uplifting. I definitely recommend young women seeking entrepreneurship become grounded spiritually and connect with a community of like-minded professionals for support.

Please tell us about Your Story Financial.

I enjoy working with women and STEM professionals by helping them craft their amazing financial success story. As a life-centered financial planner, I enjoy helping clients determine their vision, understand their values and create goals that will keep them motivated towards achieving overall financial success. From purchasing your first home to a cross-country move or even saving to launch a business, I believe everyone has a unique financial story and I love helping them develop it. We have the tools and vehicles to assist them in achieving their financial goals.

As a fee-only CERTIFIED FINANCIAL PLANNER™ professional, I’m held to strict ethical standards, had to acquire several years of experience related to delivering financial planning services to clients and had to pass the comprehensive CFP® Certification Exam before earning the designation.

Do you think there are structural or other barriers impeding the emergence of more female leaders?

I believe the biggest barrier to female leadership is understanding how powerful collaboration is. When we collaborate, there are so many great ideas shared, which helps to push the vision forward. Looking for ways to work together and building on each person’s unique capabilities allows everyone to accomplish more.

Contact Info:

- Website: yourstoryfinancial.

com - Phone: 6027301160

- Email: shehara@

yourstoryfinancial.com - Instagram: instagram.com/

moneyandmoves - Facebook: fb.com/

yourstoryfinancial - Other: https://www.linkedin.

com/in/shehara/

Image Credit:

Blue dress image credit to Fitz at http://www.fitzcrittlephoto.com/

Suggest a story: VoyageDallas is built on recommendations from the community; it’s how we uncover hidden gems, so if you or someone you know deserves recognition please let us know here.